Zillow is rising on to a positive outlook and a faster-than-expected sale of homes in its portfolio.

- Posted on February 11, 2022

- Business

- By Faith Tiza

Zillow is rising on to a positive outlook and a

faster-than-expected sale of homes in its portfolio.

Rich Barton and Lloyd

Frink, Microsoft former executives and founders of Microsoft spin-off Expedia;

Spencer Rascoff, a co-founder of Hotwire.com; David Beitel, Zillow's current

chief technology officer; and Kristin Acker, Zillow's current senior vice

president of experience design, founded Zillow in 2006.

Barton now serves as the

CEO of Zillow, Inc.

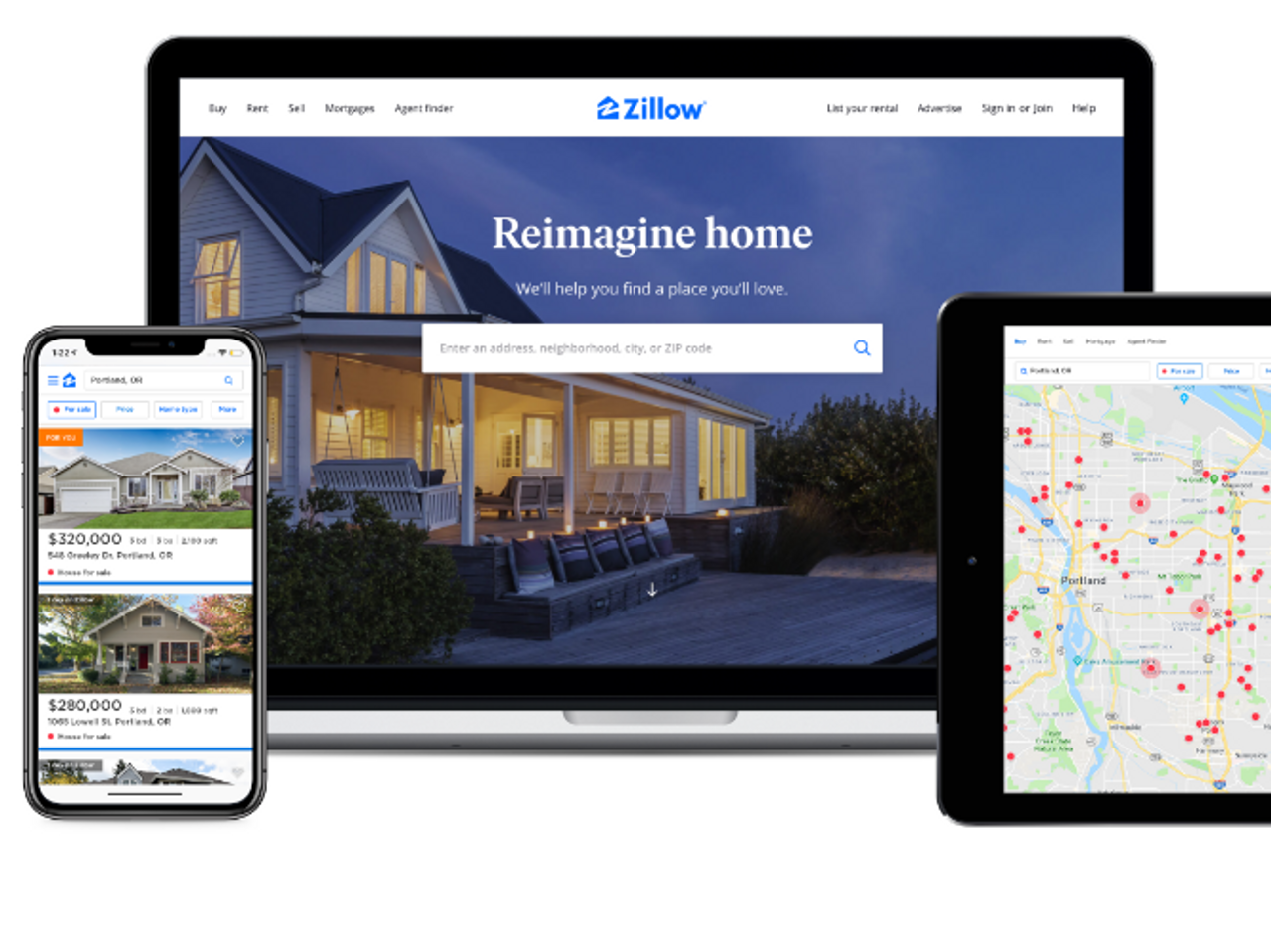

The Zillow Group is

reinventing real estate to make it easier to move on to the next chapter of

one's life.

Zillow and its

affiliates, as the most-visited real estate website in the United States,

provide customers with an on-demand experience for renting, buying, selling, and

financing which is transparent and practically frictionless from beginning to

end. In dozens of markets throughout the country, Zillow Offers buys and sells

houses directly, giving sellers control over their schedule. Our affiliate

lender, Zillow Home Loans, makes it simple for our consumers to become

pre-approved and secure finance for their next home purchase. To simplify

Zillow Offers transactions, Zillow recently formed Zillow Homes, Inc., a

licensed brokerage business.

Zillow, Zillow Offers,

Zillow Premier Agent, Zillow Home Loans, Zillow Closing Services, Zillow Homes,

Inc., Trulia, Out East, StreetEasy, HotPads, and ShowingTime are just a few of

the Zillow Group's brands, affiliates, and subsidiaries.

Increased Profits as a Result of Increased Sales

Zillow stock rose as much

as 20% in extended trading on Thursday after the internet real estate company

announced it is exiting the home-flipping business faster and more

cost-effectively than it had anticipated.

The company's

fourth-quarter earnings announcement comes after a failed attempt to get into

the iBuying, or immediate buying, sector, in which it bought homes directly

from owners. In November, Zillow announced its exit from the business,

conceding that its algorithms were unable to reliably estimate house prices,

putting the company's future in jeopardy.

The company has lost $261

million in the fourth quarter and $528 million overall, with the house's unit

accounting for the whole loss. However, Zillow reported that it sold 8,353

houses during the quarter, above its forecast of 5,000 sales, and concluded the

quarter with nearly 10,000 homes in inventory.

According to Refinitiv, the revenue of $3.88 billion for the fourth quarter was well above the $2.98

billion average analyst estimate due to a faster pace of home sales. The

iBuying section generates more than 85% of revenue, with the balance coming

from its house listings group, which is termed internet, media, and technology

(IMT).

According to FactSet,

revenue in IMT climbed 14% to $483.2 million in the fourth quarter, just

beating the $481.9 million average estimate.

Zillow estimates overall

revenue of $3.12 billion to $3.44 billion in the first quarter. Revenue was

expected to be $3.26 billion, according to analysts.

Zillow is refocusing on

the marketplace, bringing together buyers and sellers with tools and technology

to make the process easier. Working with a large network of agents and

assisting customers with their mortgages are examples of this.

By 2025, the company

plans to generate $5 billion in revenue with a 45 percent adjusted profit

margin.

After hours, the stock

reached a high of $59.04. It was down 24% this year as of Thursday's end.

So, we can safely say

that Zillow is rising on to a positive outlook and a faster-than-expected sale

of homes in its portfolio.

Be the first to comment!

You must login to comment