Super Tuesday Stock Futures Jump

- Posted on March 04, 2020

- Stock Market

- By Glory

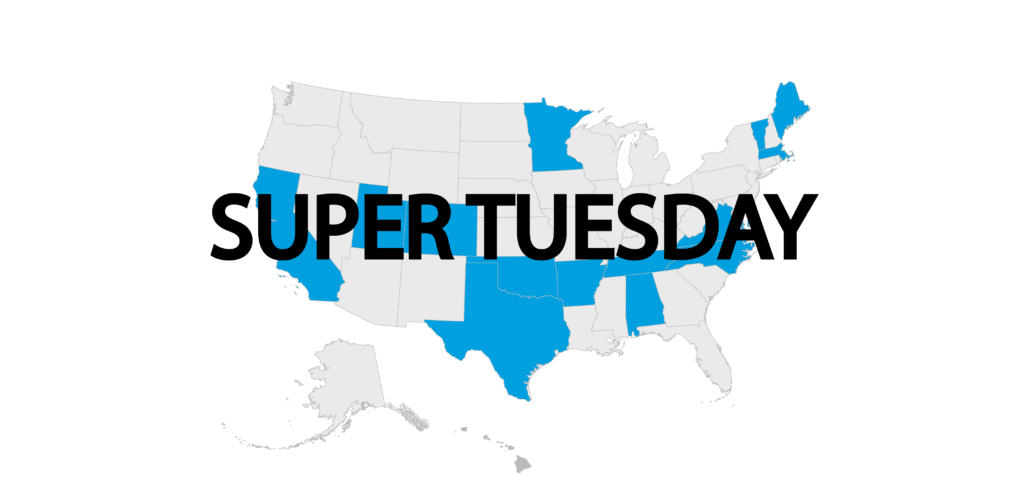

Super Tuesday’s results had a great impact on the US stock market as the US stock market futures increased following Joe Biden’s big win on Tuesday. His win not only resurrected his campaign but also put him in the leading position as Senator Bernie Sanders’ opponent for the Democratic presidential nomination.

Following the super Tuesday’s outcome, the Dow (INDU) futures were up 400 points, or 1.6% while the S&P 500 (INX) futures and Nasdaq (COMP) futures were up 1.4% and 1.5% respectively. However, all three major US indexes still closed lower following the Federal Reserve’s interest rate cut by half a percentage. The rate cut was aimed at protecting the US economy from the impact of the global novel coronavirus impact. As a result of this, the Dow closed down 786 points, or 2.9% just a day after it had recorded its best points in history.

The US stock market may have experienced its worst week yet since the 2008 financial crisis. Both the Dow Jones Industrial Average and S&P 500 fell more than 11%. Although, the S&P 500 climbed 4.6% on Monday making it its best day since December 2018. After the Feds announced the emergency rate cut, the market shuffled between lower and higher in mid-Tuesday trading.

The emergency Feds rate cut caused a brief increase in the three major indexes on Tuesday but soon reversed causing companies like Microsoft (MSFT), Amazon.com (AMZN), Apple (APPL), and Adobe (ADBE) to either hit resistance or lose support. With regard to this, some Speculators anticipate a stock market rally, but until then, the stock market correction will continue.

In the early hours of Wednesday, the Dow futures rose 1.35% vs. fair value. In the past few days, the Dow Jones has been volatile and has experienced regular trading. The S&P 500 futures were up 1.15%, while Nasdaq 100 futures climbed 1.3%.

Super Tuesday’s Results vs Wall Street

The Dow’s futures jump is attributed to the victory of the US vice president, after winning in nine states including Minnesota, Texas, and Virginia. While Sanders’ was leading in Colorado, Vermont, and California.

Wall Street is more likely going to pick Biden over Sanders as Sanders’ intentions to ban fracking, break up big banks, and institute a wealth tax has caused an alarm on Wall Street. This is also in consideration that he may likely win the Democratic primaries and possibly presidency. Biden, on the other hand, is quite moderate in his economic intentions, having more chances of beating President Trump and possibly cause tax hikes.

Be the first to comment!

You must login to comment