Buy-Side definition in Finance

The phrase 'buy-side' refers to companies that are in the business of buying others, rather than selling them. Investment banks are not usually part of this; although they may advise on the purchase o...

The phrase 'buy-side' refers to companies that are in the business of buying others, rather than selling them. Investment banks are not usually part of this; although they may advise on the purchase o...

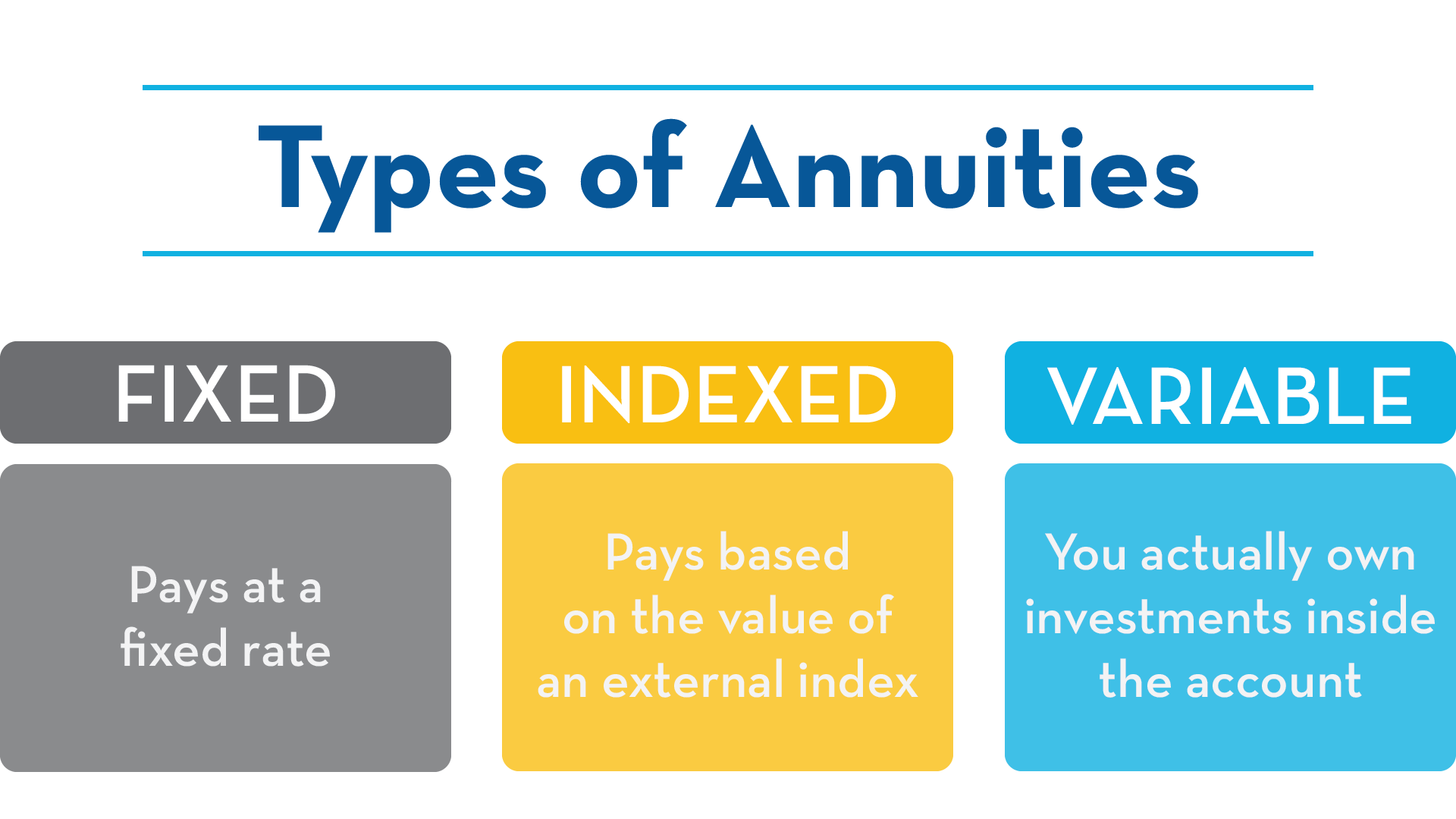

An annuity refers to a contract between an individual and an insurance company where the individual makes a lump sum payment or series of payments, and then receives regular disbursements, either imme...

FANG Trillion Dollar ClubThe trillion dollar league club is now reigning. Recently, three different stocks trading on the S&P 500 index joined the league of trillion dollar clubs. These stocks inc...

The class A shares rose 1.3 percent on Wednesday, closing at $504,400, but as of today, a BRK.A stock is selling for $518,438, their first close above the half-million-dollar mark. The Omaha-based co...

To trade stocks and other investments like mutual funds and ETFs in the United States, you must be at least 18 years old. A person of legal age, on the other hand, can open a custodial account for the...

The phrase 'buy-side' refers to companies that are in the business of buying others, rather than selling them. Investment banks are not usually part of this; although they may advise on the purchase o...

Investing in the US Stock market is a profitable investment since it is the largest stock market in the world with more than 50% of the value of the global stock market concentrated in...

A financial institution is an institution that deals with fiscal and monetary transactions such savings, lending, investing, and currency exchange. Banks, insurance companies, trust companies,&nbs...

Jobs requiring a finance degree may offer comparatively high salaries, consistency, room for promotion, and reliable demand forecasts. Employee flexibility may be provided through careers in financ...

A 401(k) plan is a tax-advantaged and defined-contribution retirement account offered to employees by their employers. The 401(k) plan has a section in the United States Internal...