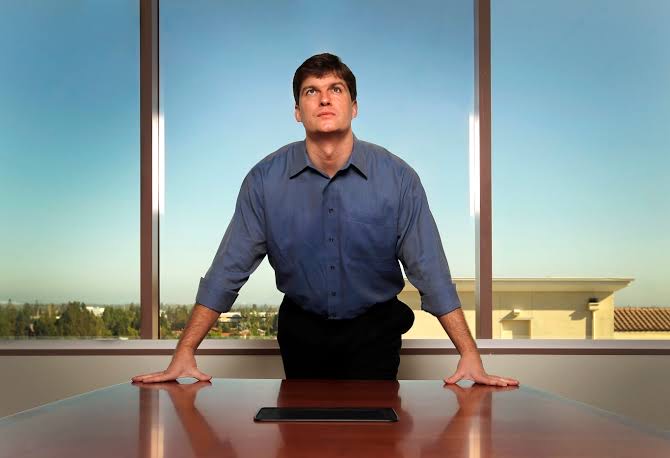

Scion Capital 13f for the fourth Quarter is out and this is what Micheal Burry is buying

- Posted on March 09, 2021

- Stock Market

- By admin

According to its latest 13F, Michael Burry's Scion Asset Management seems to be highly active in the last quarter of 2020. The report reveals that Burry gained nine new positions during the period and also added to two existing holdings. Throughout this period Burry divested two other holdings. and also reduced a further nine. The aftermath of all these activities has given Scion one of the most diversified portfolios since it began reporting its holdings in the second quarter of 2018.

Burry closed his hedge fund after the financial crisis even though in the past he had managed to save money for outside investors. Firms will only need to file 13F reports with SEC, Security, and Exchange Commission when they exceed $100 million of assets under management. It, therefore, appears logical for Scion which currently manages Burry's fortune, dropped below this level after the financial crisis but revived at the end of 2018 above the high-end watermark.

It is clear after going through the firm's recent filings that Burry loves a concentrated portfolio approach. An example is when the firm gained around 25% of assets invested in just four positions at the end of December 2020. The 13F report only reveals open equity positions and not cash or credit holdings. This means that the firm can have just as much cash sitting on the sidelines while the third quarter may have indicated Burry had 50% of Scion's assets invested in just two holdings.

The top five holdings make up 30% of assets under management. The most significant portfolio added was NOW Inc. (NYSE:DNOW). The firm acquired 1.5 million shares in this business, thereby giving it a 7.7% portfolio weight. This international distributor to the oil & gas and industrial market has witnessed more fall than rising across the previous five years.

But despite the decline Scion's balance sheet is full of cash and had a net balance of $376 million at the end of the last fiscal period. Although Wall Street analysts do not expect the business to return to profit until at least 2023, it is currently switching hands at a price to tangible book value of 1.5. The second-largest addition to the portfolio was Well Fargo (NYSE: WFC) and the third largest was GEO Group(NYSE: GEO).

These two additions account for 5% of the overall portfolio. GEO is considered a fascinating transaction for the portfolio. The firm is a real estate investment trust specializing in ownership, leasing & management of correctional, detention, and reentry facilities across the U.S (i.e it's essentially a for-profit prison company). The political factors have placed stocks under recent pressure during these weeks and months.

Hence, shares in this business after these falls are changing hands at just under book value. This comes off looking like Blurry's mode of operation as he most likely foresees significant value in this company's assets looking beyond the political headwinds currently steering buyers away. The three other stocks Burry bought in the third quarter were Molson Coors Beverage Co. (NYSE: TAP), CoreCivic Inc. (NYSE: CXW), and HollyFrontier Corp. (NYSE: HFC). Burry also divested his Gamestop (NYSE: GME) holding which formerly made up around 11% of assets in Scions's equity portfolio.

Be the first to comment!

You must login to comment