Robinhood user Alexender Kearns commits Suicide after Seeing a Negative $730,000 Balance in His Account

- Posted on June 22, 2020

- Editors Pick

- By Glory

A twenty-year-old student of the University of Nebraska as found dead by his parents on June 12, 2020, with a note on his computer which said: “How was a 20 year old with no income able to get assigned almost a million dollars worth of leverage?”

The deceased, Alexender E. Kearns earlier took his own life after seeing a negative $730,000 in his Robinhood account balance. A few months ago, it was reported on the news that Robinhood had over 3 million new users/accounts due to the coronavirus pandemic. Kearns, like so many others, signed up with Robinhood for stock investing. Robinhood is a millennial-focused brokerage firm that offers commission-free trading. It also provides users with a fun and easy-to-use mobile app to aid investing, as well as awarding new customers with free shares of stock.

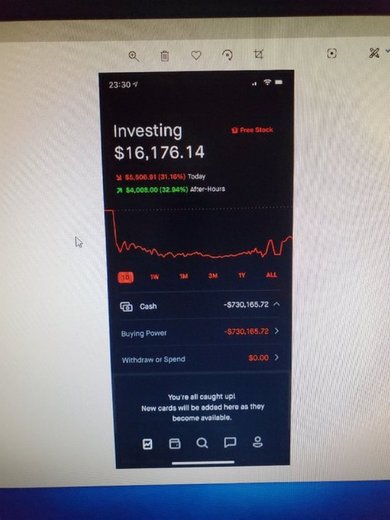

Kearns decided to give Robinhood a try and had begun experimenting with different trading options. His final words in his suicide note showed anger towards Robinhood as he said that he had “no clue” about what he was doing. A screenshot from his mobile phone showed that his account balance was in the negative with a total of $730,165 cash balance.

Robinhood is yet to share details of Kearns’ account. Many also suspect the possibility of Kearns trading the “bull put spread.” Put options allow buyers to sell stock at the strike price at any time until it expires. While Put sellers have to buy the underlying stock at the strike price when it is assigned. This is an automatic process that happens at expiration if the underlying stock’s price closes that day at a price one penny or more below the stock price. However, its founders responded to Kearns’ death by suicide, pledging to look into the matter and effect major changes to their platform.

“All of us at Robinhood are deeply saddened to hear this terrible news and we reached out to share our condolences with the family over the weekend.”

While the suicide note points at Robinhood, it is impossible to identify other factors that could have possibly led to Kearns’ death by suicide. According to Kearns’ cousin-in-law and a research analyst at Sullimar Capital Group, Chicago, the family thought “everything was going fine” until the news of his demise. Kearns’ father also said that he was having a good time in the markets and investing until Friday night when they received a call from his mother that he was dead.

The night before he died, Kearns was in disbelief that his Robinhood account, which was seen to have a $16,000 balance in it, still showed a negative of $730,165. In his note, he wrote that he never authorized margin trading and was in shock as to how his small account was able to have such a huge loss.

Both Robinhood and the authorities are closely looking into the matter as there could be a possibility that Kearns’ was afraid that he had blown up his future and wouldn’t be able to pay back the $730,000 loss. This was as affirmed in the note he left behind, saying that he didn’t understand Robinhood well enough.

Be the first to comment!

You must login to comment