PayPal Earnings Report: Q2 Report

- Posted on July 31, 2020

- Stock Market

- By Glory

Non-GAAP EPS $1.07, up 49% year-over-year

Total payment volume $222B, up 29% year-over-year

Venmo total payment volume $37B

21.3 net new active users

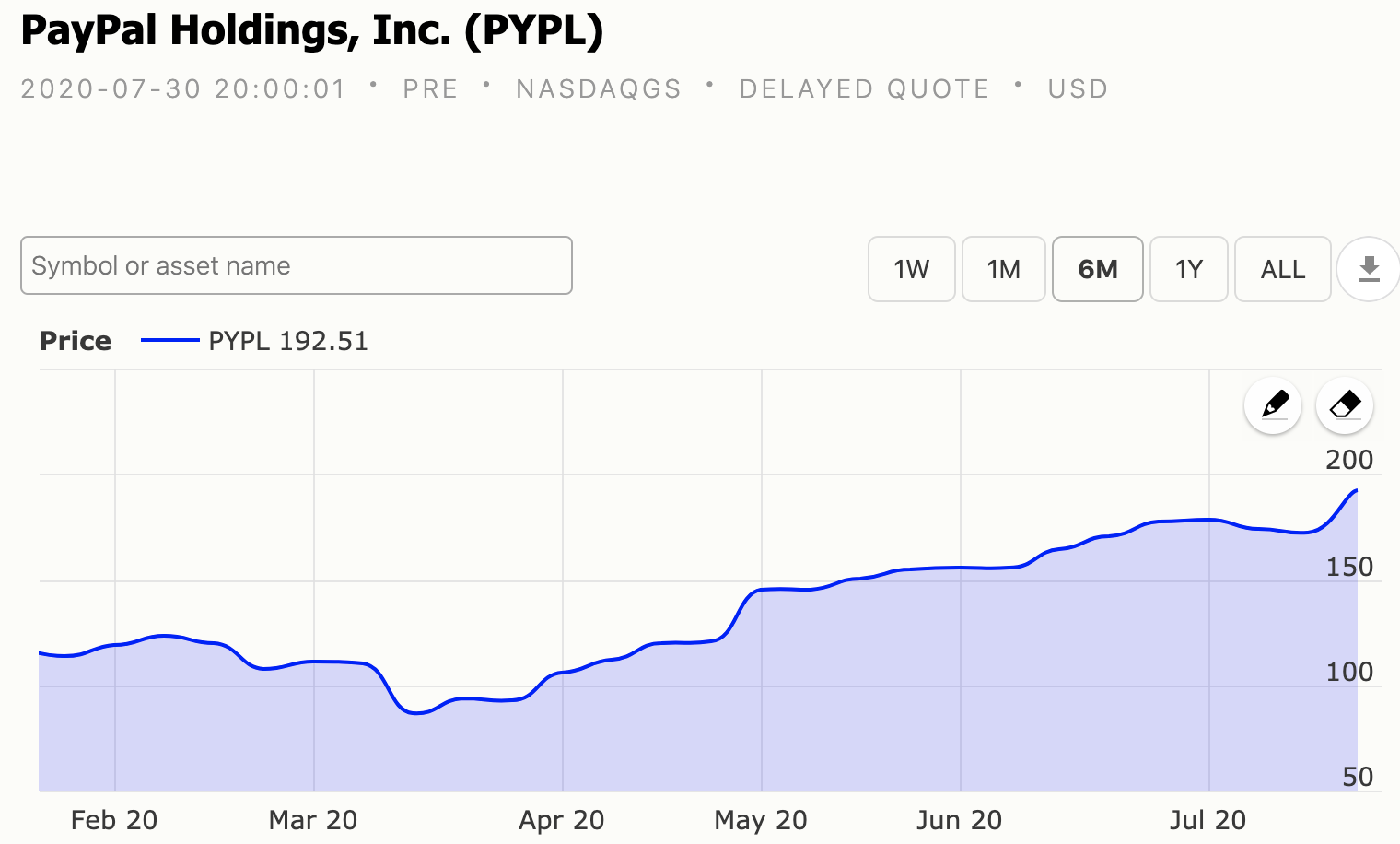

PayPal Holdings, Inc (PYPL). announced its second-quarter results for the period which ended in June, late Wednesday. The result included the quarter’s earnings, revenue, and total payment volume from merchants, topping estimates as e-commerce thrived amid the coronavirus pandemic. The company also hosted a conference call with investors on the same day to discuss the results.

The company’s earnings rose 49% compared to a year ago to an adjusted $1.07 a share. Its revenue rose 25% to $5.25 billion in the last quarter which ended June 30, 2020. A year ago, PayPal earned 86 cents a share on sales of $4.3 billion. Analysts were expecting PayPal earnings to be 88 cents on revenue of $4.99 billion. The company’s earnings result beat analysts’ expectations by far.

PayPal projected a total payment volume of $210.73 billion, but in reality saw its TPV rise 29% to $222 billion due to the coronavirus lockdown and increased online transactions.

During the extended trading on the stock market on Wednesday, PayPal stock rose 2.6% to 189.50. The company stock had a 94 out of 99 Relative Strength Rating.

Contributing to PayPal’s growth in the just-reported quarter, its Venmo person-to-person payment service also contributed to the high TPV.

In PayPal’s earnings report, the company said it added 21.3 million net new active accounts, the most it ever had in one quarter. As of the end of June, PayPal had 346 million active accounts compared to analysts’ expectations of 335 million. In the current quarter which will end in September, the company said it expects TPV growth “on a percentage basis to be in high 20s. ”It expects “revenue to grow 20% to current spot rates, while adjusted earnings to rise about 25%.

About PayPal

PayPal is a digital payment giant that has remained at the leading position of the digital payment system for over two decades. PayPal leverages technology to make financial services and commerce easily accessible and more convenient and secure for online buyers and sellers. The digital payment platform has more than 300 million consumers and merchants in over 200 markets in the world.

In 2015, San Jose, California-based eBay (EBAY) spun off PayPal. The former parent company is changing the use of PayPal for its online marketplace. EBay said by July 21, it expects “a majority of its Marketplace customers” to move to Adyen.

Be the first to comment!

You must login to comment