Nigeria's new forex plan aims for $200 billion in inflows

- Posted on February 14, 2022

- Stock Market

- By Faith Tiza

Nigeria's new forex plan aims for $200

billion in inflows

Nigeria's central bank has devised a new strategy to

entice $200 billion in foreign direct investment into the continent's largest

economy: make it more appealing for exporters to bring home foreign money.

The Nigerian Central Bank will no longer sell dollars

to local banks, instead of requiring institutions to seek foreign currency on

their own. The regulator would provide export-oriented producers with low-cost

long-term loans and try to persuade exporters to repatriate dollar proceeds and

deposit them with banks.

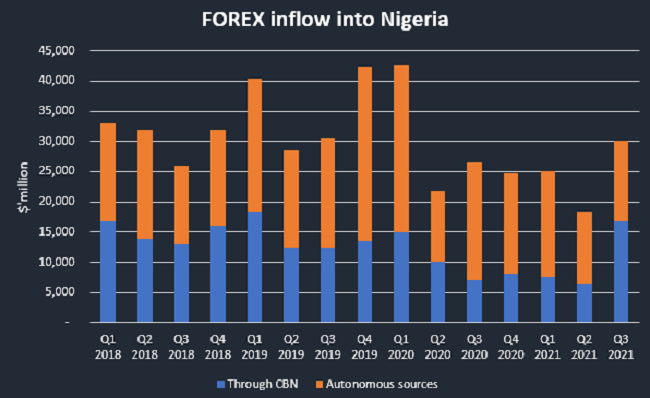

Nigeria's central bank has struggled to increase

dollar supplies and has frequently changed restrictions in the process. The

most significant shift since it ceased supplying foreign cash to money changers

will be the latest proposal. The regulator expects the measures to boost

foreign-exchange supplies in the next three to five years after the currency

was devalued three times since 2020 due to a drop in crude oil prices, which hurt

inflows.

In an emailed answer to inquiries, Yvonne Mhango,

Africa economist at Renaissance Capital, stated, "I'm not sure why banks

will be more effective at convincing exporters to repatriate their gains to

Nigeria than the central bank." "Without any guarantee that we will

see an uptick in the repatriation of proceeds if the central bank stops supplying

banks," he warned, the naira might plummet.

According to Emefiele, the regulator established an

export support facility that will provide producers with financing for up to

ten years with a two-year moratorium and a 5% interest rate. He also stated

that the central bank will extend by a year a Covid-19 interest rate benefit

that began in 2020 to assist producers.

Dollar

Deficit

The central bank intends to make it more appealing for

exporters to buy local currency and bring their revenues back home.

The 27 percent difference between the official and

parallel market exchange rates of the naira has so far deterred businesses from

repatriating foreign currency to Nigeria.

"We can truly protect the long-term worth of our

currency, as well as the stability of our exchange rate, only by strengthening

this economy's productive and earning capability," Emefiele added.

By 4:30 p.m. in Lagos, Nigeria's commercial metropolis,

the official spot rate had fallen 0.1 percent to 416.71 naira to the dollar.

In July, the central bank accused money changers of

exacerbating a dollar shortage and restricted deliveries to them, depriving the

market of over $6 billion in supply every year. In September, it issued an

order requiring lenders to identify consumers who purchase foreign exchange

using forged documents and publish their names in order to prevent dollar

arbitrage.

Be the first to comment!

You must login to comment