The Stock Market Being In An All-Time High And The Implication

The stock market has hit about nineteen-twenty new highs in the whole of 2019. After hitting a new high on July 26, the S&P 500 suffered a sharp sell-off amid ...

The stock market has hit about nineteen-twenty new highs in the whole of 2019. After hitting a new high on July 26, the S&P 500 suffered a sharp sell-off amid ...

Automated machines are being used in virtually every industry and are to stay. The recent boost in artificial intelligence has both positive and negative impacts on businesses and employ...

With the year coming to a close, Dollar Tree Inc. just signalled for a disappointing holiday earnings quarter as a result of the U.S.-China trade war tariffs. This sent its share...

Value investing is an investment pattern or model that involves buying stocks or securities that appear underpriced. The various forms of ...

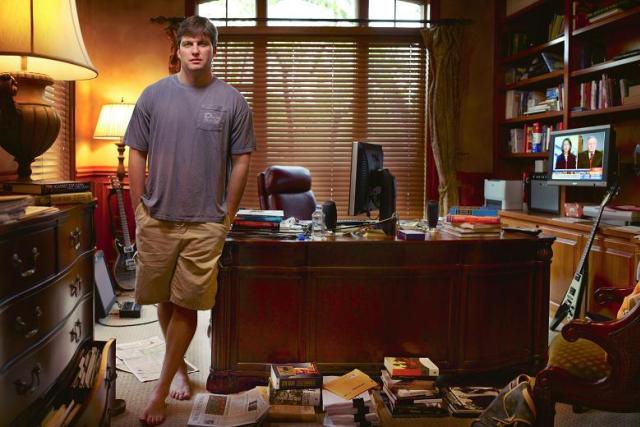

Joel Greenblatt: American academic, funds manager, value investor, and writer.Early life & educationJoel Greenblatt was born in Great Neck, New York on the 13th of December 1957. He is a graduat...

Our employees are our greatest asset, and I am delighted to honor the commitment, dedication, and longstanding colleagues who daily uphold our principles, demonstrate our vision and sustain our suc...

I constantly see people rise in life who are not the smartest sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than they were when the...

"Ick Investing means taking a special analytical interest in stocks that inspire a first reaction of 'ick'. I tend to become interested in stocks that by their very names of circum...

American technology company, Nvidia Corporation, commonly referred to as Nvidia, and concerned with Graphics Processing Units (GPU) has got its stocks soaring all high. The compa...

The New York Stock Exchange (NYSE) is trying to address the major hurdle for companies aiming to follow Spotify and Slack into the public markets, which is, the direct listing pr...