Trade Forex or Invest in Regular Stocks? Which is Better?

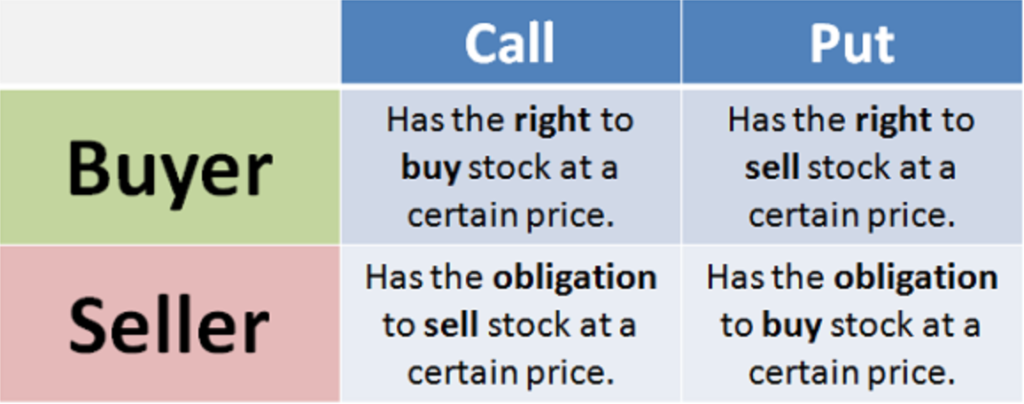

Both forex trading and stock trading provide investors with a diversity of investment opportunities, each with its own features, perks, and risk levels. Though they both deal with buying and selling, ...