Netflix Earnings - 15.77 million New Subscribers joined Netflix

Netflix (NFLX), the largest internet television network, has experienced a poor turnout in its EPS in spite of its rapid growth and skyrocketed revenue. As of Tuesday, the Netflix EPS was $1.57 against the expected $1.65 on a share sales of $5.76 billion. While on a Year-over-Year basis, earnings were up 107% and sales jumped 28%. The company said that the strong US dollar suppressed its international revenue in the first quarter.

In a report on April 21, Netflix showed a larger paid-subscriber growth since Q1 2019. Its total paid subscriptions also beat expectations. Prior to that, subscriber-growth fell every quarter as a result of fast-rising strong competitors. As a result of this, earnings were lower than expected, even though revenue slightly topped expectations. In the past few weeks, Netflix has been on competitive advantage as its subscriber growth has strengthened. However, there is uncertainty as to whether or not the subscriber growth level would be maintained once the quarantine is over.

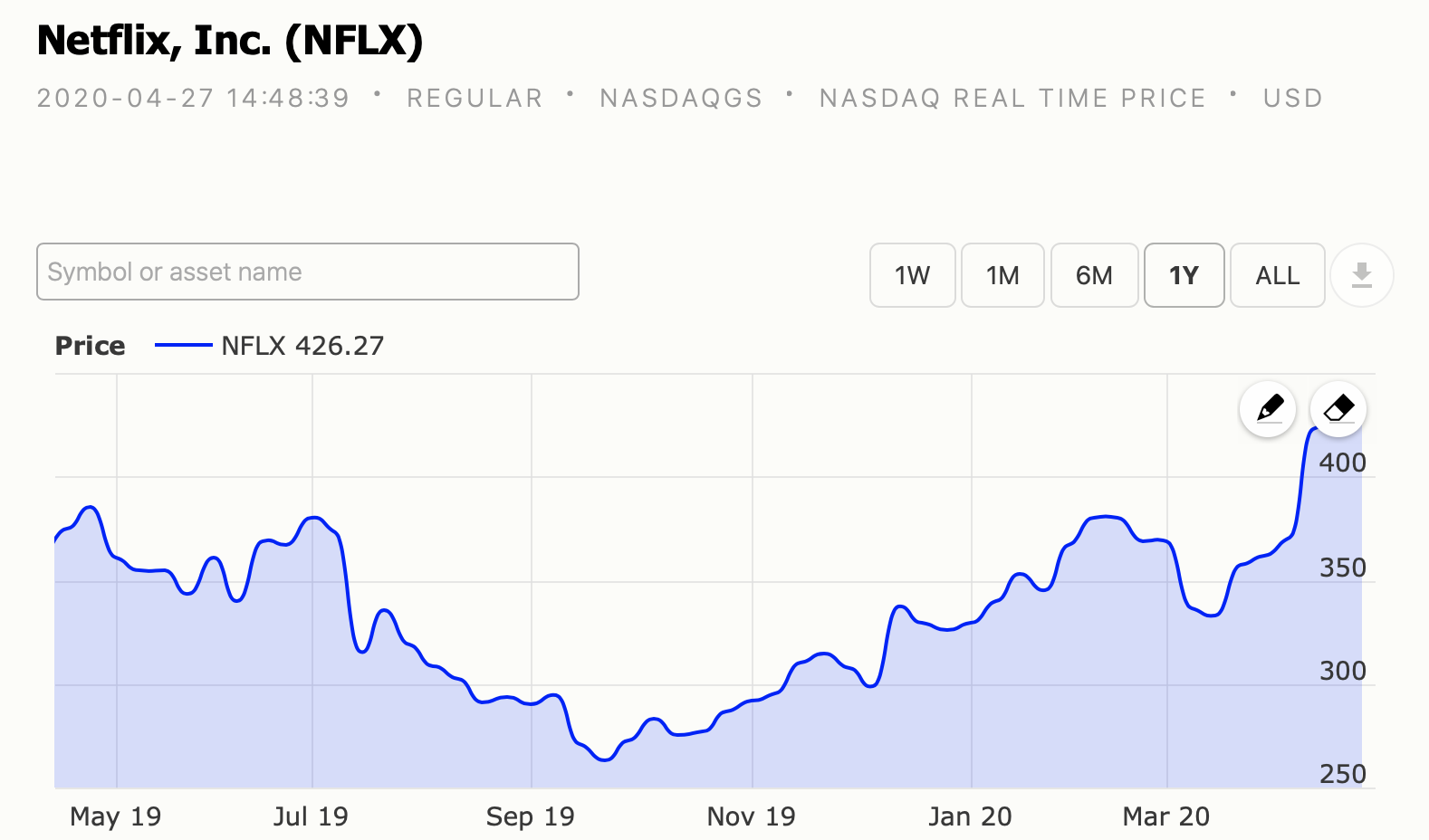

On Tuesday, Netflix reported financial reports for the first quarter, including the total of new subscribers as 15.77 million contrary to the expected 8.2 million analysts were watching out for. Compared to when the stock market crashed on March 17, Netflix shares dropped to 290.25. Only to rise to 54.9% to 449.54 on April 16, after the market stabilized. So far, in 2020 Netflix shares have increased more than 22%, contrary to the overall performance of the market due to the coronavirus impact.

Analysts have arrived at an EPS consensus for Netflix of 6.4, 8.58, and 10.83, for December 2020, 2021, and 2022, respectively. There are also expectations of high EPS of 7.08, 9.39, 12.17, respectively.

Despite Netflix’s low earnings report, some Wall Street analysts have still raised their price targets on Netflix stock. Justin Patterson, an analyst at Raymond James, increased his price target to 480 from a previous 415, however, lowered his rating from strong buy to outperform.

In a note to clients, he wrote that: “While we continue to view Netflix as a long-term winner in direct-to-consumer video, we believe the potential for positive estimate revisions and multiple expansion are limited until we observe post Covid-19 retention rates.”

Steven Cahall, Wells Fargo Analyst is of the opinion that Netflix’s premium valuation is justified given consumer behavior during the Covid-19 pandemic. He, therefore, places his Netflix stock price target at 460, rating it as equal weight. In a note to clients, he said: “we’re not optimistic that normal economic life is right ahead with test-and-trace plus vaccines still an imponderable way off.”

While governments, economies, and citizens continually await a remedy for the coronavirus, there would be a continuous demand for video streaming networks. According to Jeffery Wlodarczak, Pivotal Research Group analyst the coronavirus pandemic has placed Netflix in the leading position of video-on-demand in the future days to come. He backed up his predictions by raising his Netflix stock price target from 490 to 504.

As the coronavirus pandemic continues to ravage global economies, with billions of people staying at home, Netflix is expectant of an additional 7.5 million subscribers in the second quarter. Though analysts are expecting an additional 4.1 million nee subscribers in the second quarter. Subsequently, the number would drop as by the third and fourth quarters the coronavirus pandemic would have lessened.

Be the first to comment!

You must login to comment