Impact of inflation on the stock market

- Posted on February 15, 2022

- Stock Market

- By Faith Tiza

Impact of inflation on the stock market

In economics, inflation is defined as a gradual

increase in the price of goods and services in a given economy. Simply put, it

is too much money chasing few goods. When the general price level rises, each unit

of currency buys fewer products and services; as a result, inflation equals a

loss of money's purchasing power.

Inflation

and the stock market

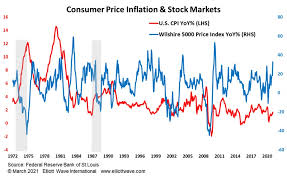

Investors can gain insight into past returns data

during periods of high and low inflation by looking at historical returns data

during periods of high and low inflation. Inflation's impact on stock returns

has been studied extensively. Regrettably, the investigations have frequently

yielded contradictory outcomes. Nonetheless, the majority of academics have

discovered that higher inflation is associated with lower equity prices.

Inflation involves rising pricing for products and

services for consumers, as well as the risk of losing purchasing power if their

income does not keep pace. Deflation, on the other hand, refers to a drop in

prices.

Consistent deflation can raise unemployment and

jeopardize the financial system and the broader economy by making debt

servicing more difficult. The Federal Reserve of the United States is aiming

for a 2 percent average inflation rate over time in order to meet its dual

mandate of price stability and maximum employment.

Sharp fluctuations in either way from a reasonable

inflation rate pose problems for both investors and consumers. This is due to

the fact that they have the potential to create major economic upheaval. They

also have a variety of and frequently unforeseen effects on different asset

classes.

Have you noticed that things are becoming more

expensive today? The average consumer has been feeling the effects of

inflation.

The federal government stated in January 2022 that the

Consumer Price Index (CPI) had grown by 7% in the previous year, the biggest

12-month gain since June 1982. The CPI measures the rate at which various

products' prices rise.

Inflation is defined as an increase in the cost of

goods and services, which reduces the purchasing power of the currency.

Consumers can buy fewer things when inflation rises, input prices rise, and

earnings and profits fall. As a result, the economy slows until the situation

stabilizes.

High-interest rates and price increases don't make for

an appealing investment profile for most investors. Stocks, on the other hand,

remain a strong inflation hedge since, in principle, a company's revenue and

earnings should increase at the same rate as inflation.

Inflation deprives investors (and everyone else) by

boosting prices without increasing the value of their assets. You get less for

more money. Inflation overstates a firm's financials since the figures (revenue

and earnings) rise with the rate of inflation, plus any additional value

provided by the company.

When inflation falls, inflated incomes and revenues

fall with it. Even if there is a tide that rises and lowers all the boats, it

is still difficult to gain a good sense of the true value.

Best

stocks for investment during an inflation

Because inflation raises the cost of commodities,

businesses that rely less on raw resources may fare better than those that

produce high-priced goods. During inflationary situations, blue-chip stocks may

outperform growth equities because they may hold less debt. For a corporation

that relies on debt-fueled expansion, any increase in interest rates will

increase operational costs. Banks, on the other hand, benefit from higher

interest rates since their lending profit rises.

Energy, financials, precious metals, property real

estate investment trusts (REITs), and consumer staples have shown to be the

best-performing stocks in inflationary environments.

Be the first to comment!

You must login to comment