How To Get Started With Real Estate Investment

- Posted on February 26, 2020

- Editors Pick

- By Victoria

As a beginner investor in real estate, have you ever gotten to that point where all the available strategies in podcasts, blogs, and videos seem overwhelming that you find yourself stuck in the middle? Not to worry, this article aim at straightening things out for you by providing you with very succinct steps to real estate investment. But before going into the steps, let's first understand what real estate is and how it works?

What is Real Estate Investment?

Real estate investment is another simple vehicle to improve your financial ability. It is the practice of making money through owning, renting or flipping industrial, residential, commercial properties or parcels of lands. Usually, investors look for these properties by themselves or by using an online real estate marketplace like the Multiple Listing Service, Roofstock, or Zillow.

Among the types of real estate investments listed above residential real estate is the commonest. Residential real estate investment includes condos, single-family homes, and townhomes that can be rented out or re-sold for the purpose of making a profit. For instance, you can buy a condo in Beach City 5 miles away from you for the rate of $100,000 and then rent this out for $100 per night. Should you be able to constantly rent out the condo every night for a year, you would make a lot of money.

Large real estate, especially those that are usually used for business purposes fall under the category of commercial real estate. Investors in commercial real estate make their money by leasing out a multifamily residential unit or office space. The basic rule used in determining commercial real estate is that anything that has more than four units in it and rented to a business or any residential business is a commercial real estate. Commercial real estate operates a type of lending criteria that is completely different from the other type of real estate investment.

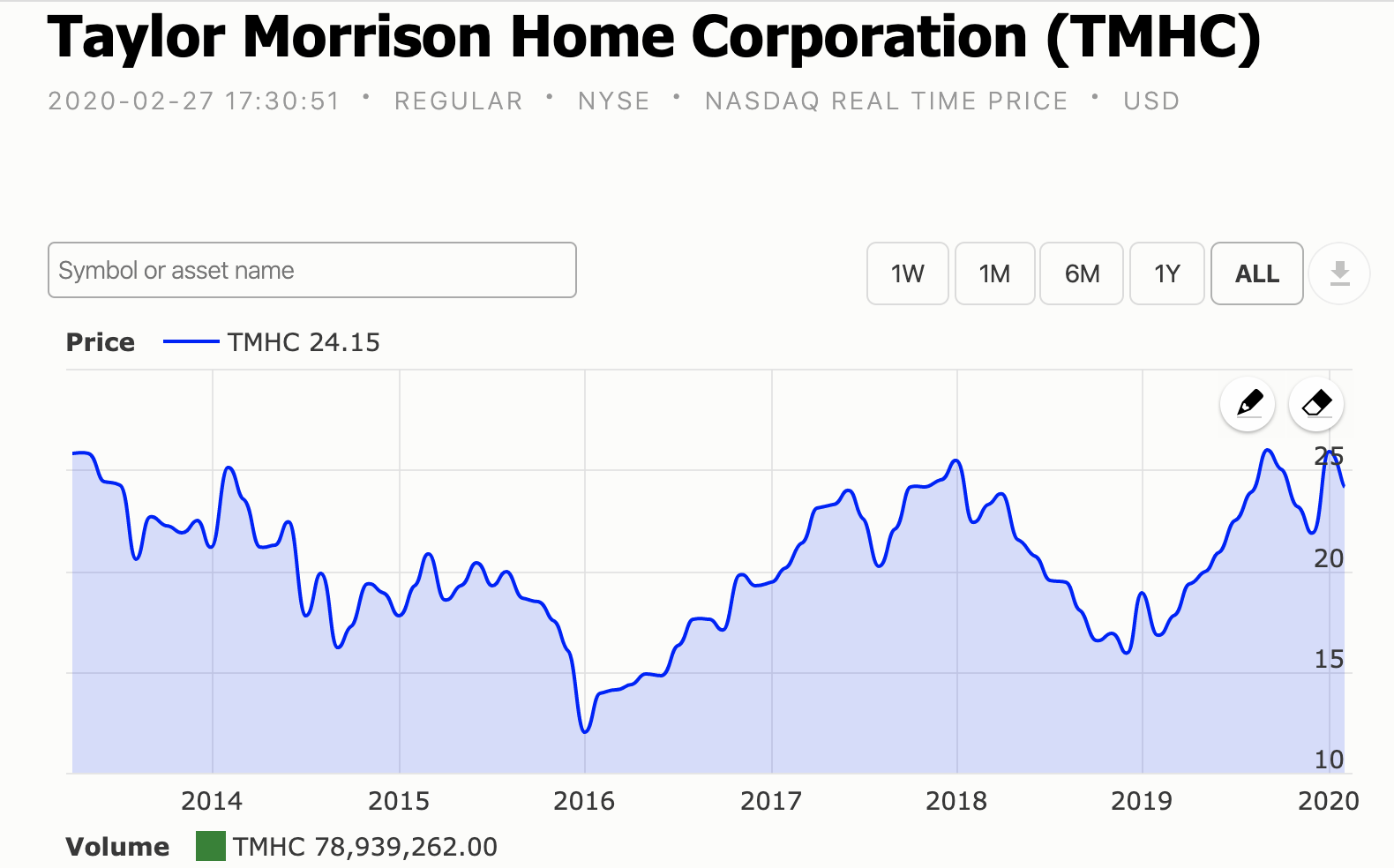

The most significant goal of all investors is to attain financial independence. Investors aim to get to that peak where all their debts are covered by their investment while they still have some benefits to cash out. The major determining factor whether you reach this goal or not is your type of investment. Real estate is one of the best if not the overall best type of investment portfolio. The profit even exceeds the S&P 500 which is within 10.5%. Real estate investment has a profit of 11.25%. Here is what the President of America has to say about real estate investment "it’s tangible, it’s solid, it’s beautiful. It’s artistic from my standpoint, and I just love real estate.” – Donald Trump

Therefore real estate is one of the investment portfolios that investors who aimed to be successful should engage in. Before examining the strategies to get started as a beginner in real estate investment, let us first look at the four basic ways to earn from real estate investment.

Rent

A real estate investor who is into condos, single-family home, townhome, commercial properties, multifamily property or even industrial real estate and crowdfunded real estate can earn his or her money from leasing out part of all of the building for a given period of time. This method of operation is that is known as rent. Generally, investors prefer to rent out their buildings because of the quick financial gain this brings. However, before giving out your estate or building out for rent ensure you check the local vacancy rates. This should even be done before making an investment.

In rent, some investors take all the money they make from the investment and handle maintenance on their own, however, not all investors do this. There are others who give out the maintenance sections to professionals or companies to handle. Whether you choose to handle the maintenance yourself or you give it out to professionals to handle for you, be sure that with rent on real estate, you will make a quick profit.

Appreciation

In some real estate where market property cost is on an upward trend, property owners can make their profit by purchasing and holding the property. Appreciation comes in as an increase in property value over time and this becomes profit when the property owner decides he or she want to sell the property.

This type of real estate investment and method of operation is generally advisable for people who are looking forward to a long-term investment in a market where property prices are increasing steadily. This is because, during the long-term period, real estate prices would always be appreciated.

Tax Benefit

This is one aspect newcomers in real estate investment don't usually take into consideration. Truth be told, as a real estate investor, you are a business owner and as such you get tax-deductions. Tax-deductions would include an upgrade in the property, having a home office, your cost of travel, supplies needed for cleaning and maintenance, the list goes on and on as needs and request plummets.

The most significant type of tax benefit in real estate investment is depreciation. This is the money charged by investors at the end of each tax year. By depreciation, it simply means that the IRS allows the owner of investment properties to depreciate the property for a given period of time. Usually, the approved period IRS permits investors to depreciate a property is 27.5 years. For instance, you buy a property for $270,000, and the IRS permits you to take a tax loss of $10,000 per year as a depreciation value. This means for the next 27.5 years you are allowed a tax-loss of $10,000.

This is definitely a huge return value because what you earn from having to sell a deductible each year surpasses the token that would be paid to the IRS department.

Interest

This method of earning from real estate investment is mainly operated by real estate investment companies and equity firms. In this aspect, the equity firms or investment companies act in the form of a bank by giving out real estate loans to real estate developers or investor and they collect some interest and fee.

Strategies To Start Investing In Real Estate Investment

Identify Your Financial Stage

It is true that real estate investment is a vehicle for financial dependency, however, it is important that you have an overall financial picture. This implies that you have a clear picture of the amount you intend to get from each investment.

Also, define the amount you want to use for the investment. This is the first and most basic step towards going into real estate. By defining the amount you want to use, you would have a clear understanding of the real estate investment you can go into and those you cannot afford. After sorting out the amount you want to use for the investment, move on to the next step.

Choose A Specific Real Estate Strategy

Usually at this stage beginner investors start creating an almost 20 pages business plan that would do well in the MBA program. However, drawing a business plan is not the goal. Your aim is to start investing in real estate investment.

Therefore, the most important and effective way to choose a real estate investment option is to choose just one, not two and not three. Starting with one real estate investment option will help you move gradually from your current financial status to the next stage. This does not mean that you won't explore other available option, it is only important to start with one option so that you can be more focused. Also starting with one real estate investment before diversifying would help build your confidence. Here are some real estate investment strategies you can start with.

- Survival

- Stability

- Saver

- Growth

- Income

Choose A Target Market

With the different high price of many real estate investment options, many new investors are confused with choosing between close home or new market. This aspect is important because your choice of the market would determine the result you get.

When faced with the choice between these two options, it would be better to start with a local real estate investment. Starting with real estate within your local environment gives you the opportunity to get detailed information about the real estate you are investing in. Though managing real estate from a distance also had its own advantage, being local has a better edge of control over distance real estate. To be able to manage a real estate investment from a distance, you would need a market analysis of the investment. This is why choosing within your terrain gives you more edge. Therefore before engaging in a distance real estate investment, explore the local choices first.

Know Your Investment Property Criteria

Investment property criteria are what reveals to you what it means to have a very good investment. When determining your property criteria, it is advisable to work with a written investment profile and share this with your potential partners and investors. The two most important information that should be contained in your investment profile includes:

- Target terms

- Target property

To make your target property clearer and more defined, it is better you have a niche. This is simply deciding which session of the entire market you wish to focus on. After choosing a niche, your investment profile should be similar to this:

- First, the description of the real estate and the target audience, for instance: Ideal single-family houses with 3 bedrooms and 2 baths in the 20152, 20155 & 20166 zip codes.

- Second, the target price range of the real estate for instance: between $100,000 to $150,000.

- Third, the description of the setting of the property

For instance, ideal properties are located in a serene and peaceful street with garage and other useable yards. It is also very convenient and accessible for school students and for outings.

Build Your Team.

Real estate investment also entails that you build a team with you as the team leader. However, this does not mean that you would need employees, but you would need the help of advisors and independent contractors to help put you through and ensure you are on a safe landing. The categories of team members as highlighted in the book titled "The Millionaire Real Estate Investors" include

Inner cycle: this includes your personal or close relationships like your spouse, mentor, business partner and so on.

Support circle: this includes your critical relationships. They are the people who would help you with the task in the real estate market. They include:

- Property manager (if applicable)

- Certified Public Accountant (CPA)

Attorney specializing in real estate and/or business

Lender(s), this would include:

Hard money lender – for short-term financing.

Mortgage lender – for long-term financing

Private money lender – for short or long-term financing.

Service circle: these are functional relationships to help you with the task you would need for your investment.

- Home inspector

- Closing agent/title company

- Plumber

- Electrician

- HVAC technician

- Painter

- Handyman

- Pest. & Moisture control

- Yard service

- General contractor (for bigger remodels and pulling permits)

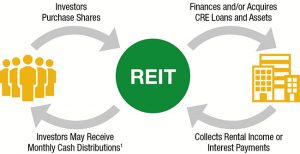

Buy REIT

REIT(real estate investment trusts) is a good way to get started with real estate investment, especially if you don't want to maintain physical transactions and dealings. REIT allows you to invest in real estate investment without a physical real estate.

REITs are basically dividend-paying stocks that center on commercial real estate investment with long-term cash producing leases. It is often connected with mutual funds. A REIT portfolio is created by corporations who use investors' money to purchase and run commercial real estates like apartments and hotels, retail spaces, office buildings, and multifamily spaces. Corporations operating the REIT type of real estate investment payout 90% of its taxable income in the form of a dividend. This is to ensure that it continues to maintain its REIT status. This is why REITs are generally exempted from income tax in comparison to all other types of real estate investment.

Pros: REIT allows investors entrees into a nonresidential investment like office buildings, malls and other types of commercial real estate investment. This type of investment is something the individual might not even be able to purchase directly.

REIT is exchanged-traded hence they are highly liquid. This means that as an investor you won’t need a title transfer and a realtor to help you cash out your investment. Also, you can easily reinvest the money into other investment plans.

To invest in REIT, simply make your purchase from an online broker.

Cons: although REIT is generally considered as a very good choice for real estate investors who are just getting started in the business, the type of REIT you purchase determines the height of risk you would be facing. For instance, if you are buying a non-traded REIT's since they are generally not easily sold out, getting the desired value for the investment might be very difficult. Therefore it is advisable that new investor sticks to publicly traded REIT. This can be gotten from brokerage firms. To be able to do this, you would need a brokerage account.

Summary

Real estate investment is one of the surest ways of becoming successful as an investor. With real estate, it is possible to build a great investment portfolio. However, before you invest in real estate, there are some things to take into considerations and some research that must also be done. A lot of these have been explained in detail in this article.

Be the first to comment!

You must login to comment