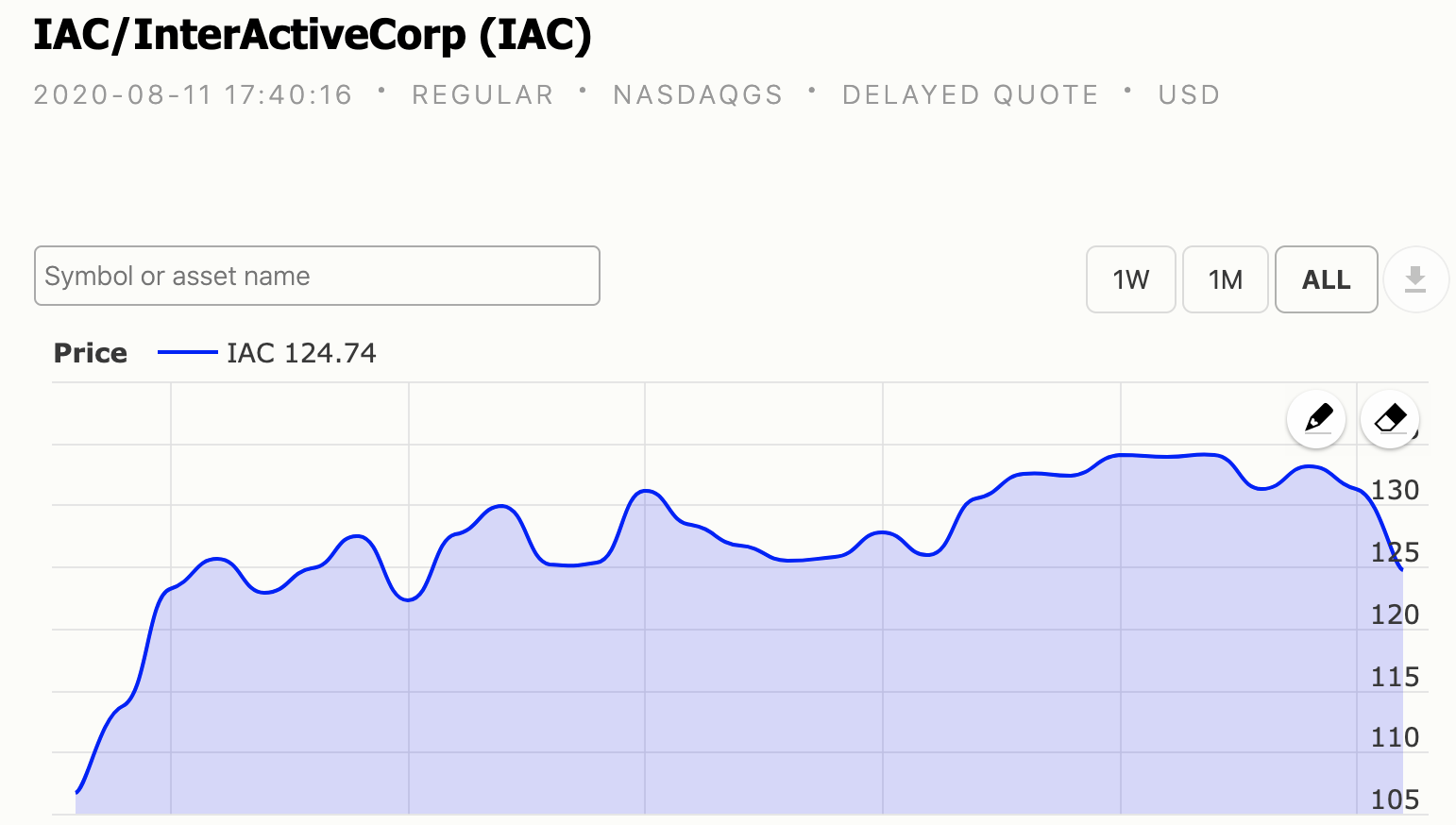

Following its Spinoff of Match.com IAC Stock Slips After Earnings

- Posted on August 11, 2020

- Stock Spinoff

- By Ugochukwu

As InterActiveCorp (IAC) recently finalized the

distribution of its majority stake in Match.com to shareholders, its shares

were trading lower on Monday, following the first earnings report.

IAC is an American holding company that owns a variety

of internet businesses. The company posted revenue of $726.4

million, which was up 5% from a year earlier adjusted for the transaction with

Match.

With its largest single

asset being its 85% stake in ANGI Home-services, it revealed revenue of $375.1

million for the quarter which ended in June, this was up 9% from what was reported

a year earlier, and was ahead of the Street at $363.4 million. But shares from ANGI

were down 6.3% to $14.52 after hours.

IAC’s video production tools

business, Vimeo, had a revenue of $67.3 million, up 47%. The company’s search

business which includes Ask.com, had its revenue at $133.3 million, down 32%. For

Dotdash which is a collection of web content companies, it had a revenue of

$44.6 million, up 18%. For other emerging segments of the company, there was a

revenue of $108.1 million, up 60%.

The recent policy that

was adopted by IAC, would see that it provides monthly updates on its business

lines. As disclosed by ANGI, it showed that its July revenue was up 7%, down

from 15% in May and 14% in June. This could be seen as for the pressure on its

shares.

For Vimeo, revenue in

July was up 40%, 22% at Dotdash. It was down 26% for search and up 76% for

others which are emerging.

It was reported on Monday

that IAC disclosed an investment of about $1 billion to acquire a 12% stake in

MGM Resorts which is a casino company. 35% of all hotel rooms on the Las Vegas

Strip are owned by MGM, which is widely known for its hotel-casino properties.

According to IAC, the

investment “presented a ‘once in a decade’ opportunity for IAC to own a meaningful

piece of a pre-eminent brand in a large category with great potential to move

online.”

CEO Joey Levin and

founder Barry Diller said in a letter that was issued to shareholders at the

company that “IAC has always been opportunistic with its capital, and if

ever there was a time, this moment is unique. We believe we can generate

compelling returns for our shareholders and hope our expertise will be additive

to MGM’s opportunities, but even if we never advance our involvement from here,

the value was too compelling to ignore. Having taken this step, we have a very

long-term view of this investment and will be open to all the opportunities it

presents along the way.”

From the start of the

year through Friday, MGM shares had fallen 42%.

Shares from IAC were down

3.5% to $126.70 and the stock as well dipped 1.3% in the regular session. For MGM

resorts it rallied 13.8% in regular trading and had slipped 1.2 after hours.

Be the first to comment!

You must login to comment