Allegations against Flutterwave

- Posted on April 14, 2022

- Editors Pick

- By Faith Tiza

Flutterwave is a Nigerian fintech firm that provides

payment infrastructure to international merchants and payment service providers

across Africa. Iyinoluwa Aboyeji, Olugbenga Agboola, and Adeleke Adekoya formed

the company in 2016, and it is based in San Francisco, California, with

operations in Nigeria, Kenya, Ghana, South Africa, and seven other African

nations.

Flutterwave received a $170 million Series C

fundraising round in 2021. This was the greatest amount ever raised by an

African digital business at the time, and it gave Flutterwave a valuation of

over $1 billion, making it a unicorn. [1] Y-Combinator, Visa Ventures,

Mastercard, Avenir Growth Capital, and Tiger Global Management are among the

investors in Flutterwave. Flutterwave also raised a US$250 million Series D

fundraising round in 2022, valued at about US$3 billion.

Flutterwave launched Send, an African-focused

remittances service, in December 2021, and immediately named Ayodeji Ibrahim

Balogun, better known as Wizkid, a Nigerian Grammy Award-winning international

musician, as its global ambassador to further promote the company's brand among

Africans in the diaspora.

Flutterwave and AfroSport Network teamed up in January

2022 to broadcast the 2021 Africa Cup of Nations free-to-air from 9 January to

6 February 2022.

Flutterwave, Africa's most valuable startup, is under

fire for alleged questionable commercial and personal actions by Olugbenga

Agboola, the company's founder and CEO.

Allegations

against Agboola

Agboola is alleged to have created a phantom

'co-founder' identity to give himself more shares in the company's early days,

and offered share prices below the company's valuation to employees who wanted

to cash in on their vested options, according to a story published Apr. 12 on

West Africa Weekly, a Substack newsletter by David Hundeyin, a Nigerian

journalist. According to the story, the employee stock sales went to an

investment vehicle owned by Agboola.

Employees were forced to sell their stock options to

an investment vehicle run by Olugbenga Agboola, according to

Hundeyin. According to Hundeyin's report, they sold for less than market

value, as estimated by Agboola, and this is classified as insider

trading. But first, let's look at how employee stock options work.

Employee stock options (ESOs) are a type of

compensation that a firm offers to its employees. This allows them to purchase

shares in the company at a defined price. However, the stock must have been

vested before they can access the shares.

Vesting simply means that you can now exercise or

purchase the company's stock. It happens gradually, so if the contract

specifies a four-year vesting time, you won't be able to completely exercise

your stock option until four years have passed since the contract was signed.

You may be able to access the vested portion in some

situations. Let's have a look at an example. Chike is the owner of ESO in XYZ.

He had to work for the corporation for four years before exercising his option,

according to the contract. He has access to 25% of the shares in the first

year. If he decides not to, he will be able to access half of the ESO in the

second year, and this will continue until the fourth year when he will be able

to access 100%.

ESOs are only beneficial if the company's stock price

climbs above the agreed-upon price. So, if Chike is advised that the best time

to buy the stock is when it increases to $3, he can buy it for $3 if it rises

to $4.

So,

was there any insider trading going on?

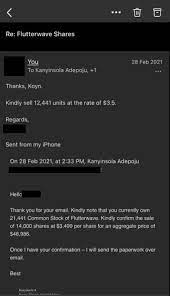

This employee appears to have exercised his option to

buy but subsequently wished to sell those shares, according to a screenshot

supplied by Hundeyin on February 28, 2021. They are offered the option to sell

at $3.4999, which they accept after rounding up to $3.5.

He also allegedly did not disclose to Access Bank, his

previous employer, that he was working for them while creating Flutterwave in

the early days of the latter, so taking undue advantage of his position and

assets at the bank. At Flutterwave, there was also talk of sexual interactions

with subordinate female employees.

Quartz has requested an official word from Flutterwave

and will update the article once one is received. But here is the story of one

of the supposedly harassed females who spoke out:

Clara Wanjiku, an ex-employee of Nigerian payment

business Flutterwave, released a Medium post on Monday, April 4, criticizing

the company's CEO, Olugbenga Agboola, for "5 years of continual

harassment."

Wanjiku says in the post that she was not paid her

"dues" after departing her position as Head of Implementation at

Flutterwave (Rest of Africa) in 2018, and she sued Flutterwave for it.

Clara said in her article that she received calls from

a number of Flutterwave employees after she filed her lawsuit, requesting to

talk and address the issue outside of court. Flutterwave eventually paid her

"dues."

There's more, though...

The company also accused Wanjiku of being behind a

Twitter account that accused some male members of Flutterwave's management of

sexual harassment, according to Wanjiku.

She claims Agboola "sabotaged" her attempt

to acquire a job at a Nigerian bank after she left Flutterwave by telling her

she was a lousy worker.

Wanjiku filed a lawsuit against Flutterwave for

damages because the corporation failed to remove her as the primary contact on

their M-Pesa account. After the account reported a fraudulent transaction, the

police pursued Wanjiku and her family.

Wanjiku sought $900,000 in damages for the claimed

negligence, but the court only granted her $2,500, which she refused to accept.

These allegations come at a time when African startups

with toxic workplace environments are being targeted. TechCabal is looking into

this story and has reached out to Wanjiku and Flutterwave for comment.

Now Clara Wanjiku Odero is the CEO and Co-Founder of

Credrails and holds a Bsc from Kenyatta University.

The connection between Agboola and Flutterwave

The 37-year-old Agboola is one of Africa's most

well-known entrepreneurs, thanks to Flutterwave's status as an early mover in

Nigeria's online payments sector and its unparalleled $3 billion value. He has

a reserved demeanor and offers few media interviews, although he appears on a number

of lists aimed at highlighting African achievement, including Quartz Africa's

2019 innovators, Fortune's 2020 list, and TIME's 2020 list (2021).

Agboola's profile has grown beyond his leadership at

Flutterwave in the last year, thanks to a flurry of personal investments in

other African firms. A few hours after yesterday's West Africa Weekly piece

went up, he won a Business Insider award for "Tech Investor of the

Year."

Flutterwave has also ventured into corporate venture

capital, co-leading a $3.4 million deal for Dapio, a UK-based fintech. The

company's $250 million financing in February would be used to fund investments

and aggressive marketing.

Flutterwave's

wings reveal flaws

However, suspicions about Agboola and Flutterwave have

grown in recent days after a former employee, Clara Wanjiku Odero, accused

Agboola of bullying and the company of incompetence that led to fraud. Despite

Flutterwave's denial, Odero, who is now the CEO of a Softbank-backed Kenyan

fintech called Credrails, did not respond to Quartz's calls for comment. A

story that appeared to depict her in a negative light while extolling

Flutterwave's unicorn ride may have led her to write about her experience at

the company. During a retreat in Ghana this year, the company's leadership, including

Agboola, were interviewed for the piece.

Following that private trip, the corporation is now

facing public scrutiny over a number of issues raised in this week's exposé,

including a rumored US Securities and Exchange Commission ethics inquiry in 2018.

(Flutterwave is incorporated in Delaware and headquartered in California). The

SEC did not confirm or deny the inquiry, citing confidentiality concerns.

Former Flutterwave co-founder Iyinoluwa Aboyeji admitted there was one, but

contested the Substack journalist's assessment.

The majority of observers have rekindled their fury at

Nigerian companies' corporate dysfunction and bad work culture. Some people are

concerned that international investors, who are increasingly pouring money into

African businesses, may be frightened. If Flutterwave answers the claims,

the next step might be vindication for Flutterwave and the ecosystem, or a

dance between damage control and course correction by interested parties.

Or, as Matt Flannery, co-founder of Branch, a loan

service that operates in Nigeria and Kenya, predicts, further revelations that

amplify the shockwaves already sparked.

Be the first to comment!

You must login to comment