By admin Sep, 21, 2022 Featured

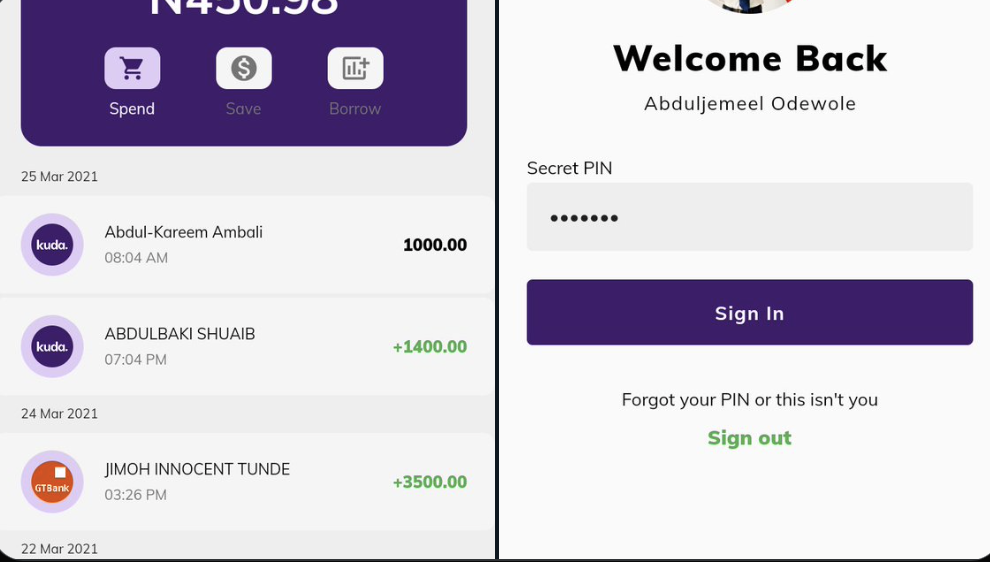

The most recent report about Kuda bank is not impressive at all and this may make them lose customers and then see reduced valuation.

Kuda bank started its business as a free bank for Nigeria. After years of operation, the company is in trouble financially. Recent reports show that the bank lost N6billion because of 69% of their loans.

They are also spending a lot of money on the market that did not convert to paying clients.

“By the end of the 2021 financial year, Kuda Bank recorded a loss of ₦6,092,554,866 ($14,214,681), a 602% rise from the ₦868,062,000 ($2,025,295) loss it made in 2020, according to a financial report released recently.

So what next for Kuda bank? how can they bounce back and make their way to profitability? Also, what does this means for buy now pay later companies in Nigeria?

Tags: Kuda bank. kuda

Share On Facebook Twitter Linkedin Whatsapp Telegram

Categories

Latest Post

- Nigeria Taps Global Markets with $2.25B Eurobond Sale

- Boeing Shares Rise as CEO Confirms China Deliveries to Resume Next Month

- STOCK SPOTLIGHT: UNION HOMES REAL ESTATE INVESTMENT TRUST (UHREIT)

- Nvidia Q1 2025 Earnings Report Summary

- 📉 U.S. Market Summary – May 28, 2025

- CBN Launches New Financial Tools to Boost Nigeria’s Non-Interest Banking Sector! ✨

- Market Watch: Key Updates as Wall Street Awaits Nvidia and Salesforce Earnings

- U.S. Equity Markets Rally as EU Tariff Deadline Is Extended and Consumer Confidence Surges

- Things to Know Before the U.S. Stock Market Opens

- What to Expect in the Markets This Week (May 27–31)

Start investing with Acorns today! Get $5 when you use my invite link: Z24WWE