By Glory Aug, 18, 2020 Private

The U.S. elections are always an opportunity to make history in the country. What some people don’t know is that the elections can have a major impact on laws, policy, foreign relations, and the stock market. This shows that elections go beyond the man and the party, but the best interest of the nation.

The Stock Market vs Elections

Over the years, U.S. Bank analysts have taken time to study market data of the past years, especially over the last 90 years. By doing this, they have been able to identify repeated patterns that have occurred throughout the election years. Their predictions may be based on merely historical data, however, some of these patterns tend to repeat themselves more often than others.

In a market data review of the S&P 500 in the 1930s, analysts found out that on average, both stock and bonds market dropped in their performance from the year leading up to the presidential elections, than other times. The results of the presidential elections also determine how soon the market picks up. The stock market can be affected by a presidential election both before and after the election.

Depending on the elected candidate after a presidential election, stock market returns have the tendency to be either slightly lower for the following year. Bonds may tend to outperform the market slightly after elections, as it makes no difference what party wins, but it may matter when the leadership of the White House changes hands.

The analysts also discovered that when a new party comes into power, the stock market gains 5% on average. However, if the same president is re-elected or the same party remains in power, returns were slightly higher at 6.5%.

Tom Hainlin, a national investment strategist at U.S. Bank said the equity market underperforms during a general election. Adding that, the underperformance wasn’t to “the point where we have concern for client portfolios, but that’s what we’ve seen from historical evidence.”

“With presidential elections, you need to make sure to have all the components of a diversified portfolio in place, and then stick to a longer-term strategy that’s designed for more than one election cycle.”

Based on the analysts’ findings, in any given 1-year period, equities yielded gains of about 8.5%, but in the year leading up to a general election, gains amounted only to 6.5%, compared to their average 7.5% in any given year.

The Upcoming Presidential Election

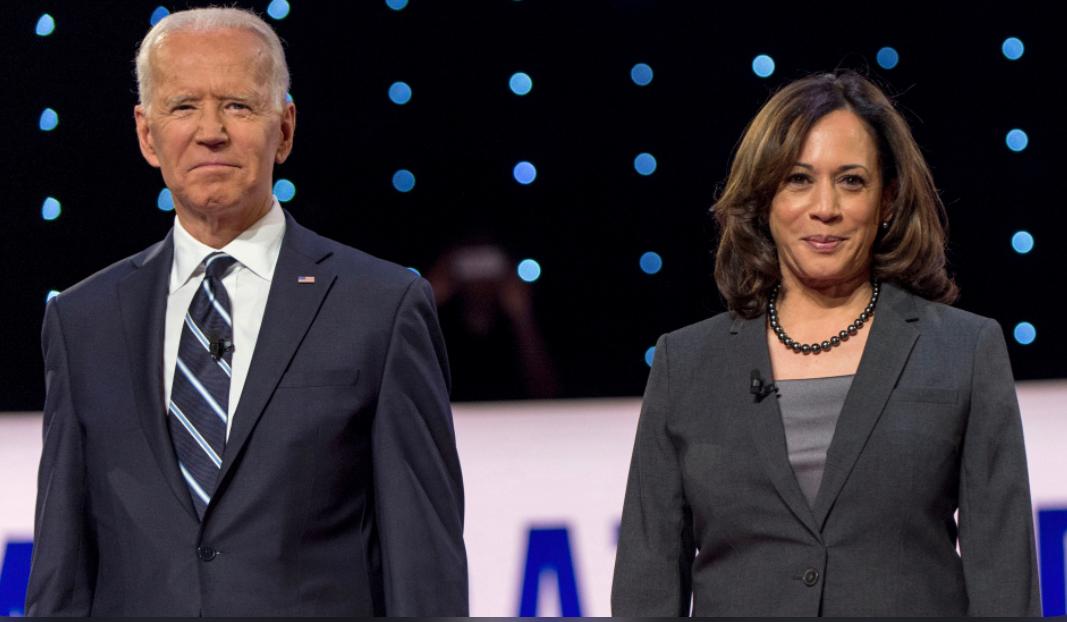

The 2020 presidential election race is as intense as always, giving investors a run for their money.

“With just 84 days remaining until the U.S. Presidential Election, now’s the time for investors to ‘President-proof’ their investments,” wrote Nigel Green on the TheStreet’s Ecomonitor. Adding that though other presidential candidates, especially Joe Biden, are fast gaining on President Trump, his “position is no longer weakening.” The past five months have been a trying period for the Trump administration due to the impact of the coronavirus on the U.S. economy.

“Therefore, it’s not hard to forget that the defining issue of 2020 for investors was always supposed to be the U.S. Presidential Election. Whoever wins on November 3, we will likely see some key policy shifts which may impact investments, tax, regulatory landscapes and corporate earnings, as we as other issues, over the coming four years,” Green wrote.

Tags: Stock Market Presidential Elections

Share On Facebook Twitter Linkedin Whatsapp Telegram

Categories

Latest Post

- Nigeria Taps Global Markets with $2.25B Eurobond Sale

- Boeing Shares Rise as CEO Confirms China Deliveries to Resume Next Month

- STOCK SPOTLIGHT: UNION HOMES REAL ESTATE INVESTMENT TRUST (UHREIT)

- Nvidia Q1 2025 Earnings Report Summary

- 📉 U.S. Market Summary – May 28, 2025

- CBN Launches New Financial Tools to Boost Nigeria’s Non-Interest Banking Sector! ✨

- Market Watch: Key Updates as Wall Street Awaits Nvidia and Salesforce Earnings

- U.S. Equity Markets Rally as EU Tariff Deadline Is Extended and Consumer Confidence Surges

- Things to Know Before the U.S. Stock Market Opens

- What to Expect in the Markets This Week (May 27–31)

Start investing with Acorns today! Get $5 when you use my invite link: Z24WWE