By admin admin Nov, 19, 2019 Financial Terms

Depreciation is when an asset is deemed to have reduced in value. No tangible asset can last indefinitely and therefore at some point, the asset will no longer be usable and will have to be recorded as a loss on the income statement. Depreciation allows a firm to allocate a percentage of that loss to different periods.

One of the reasons for using depreciation is so that when a very expensive asset such as a factory is no longer useful and is worthless, the company does not have to record a massive loss in a single period which would drastically affect performance. Depreciation allows this large loss to be allocated to lots of different periods in small amounts.

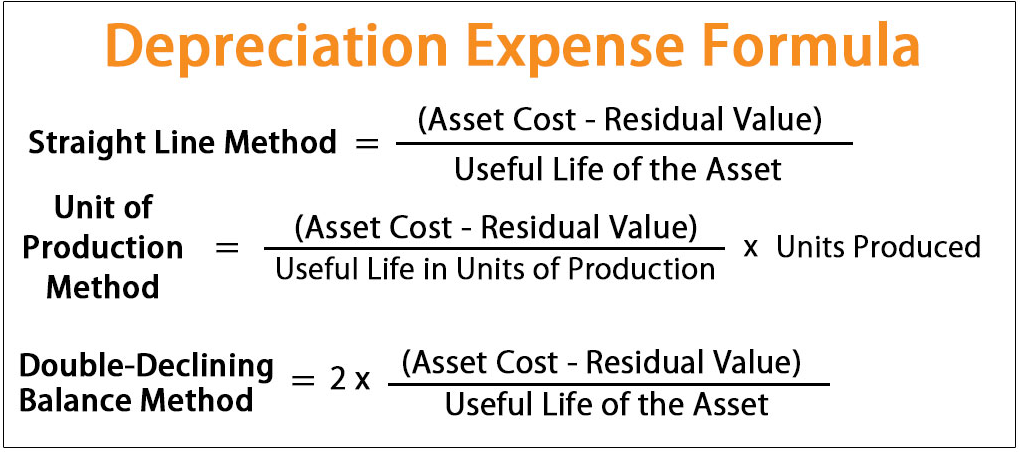

How to Calculate Depreciation

Tags: D

Share On Facebook Twitter Linkedin Whatsapp Telegram

Categories

Latest Post

- Nigeria Taps Global Markets with $2.25B Eurobond Sale

- Boeing Shares Rise as CEO Confirms China Deliveries to Resume Next Month

- STOCK SPOTLIGHT: UNION HOMES REAL ESTATE INVESTMENT TRUST (UHREIT)

- Nvidia Q1 2025 Earnings Report Summary

- 📉 U.S. Market Summary – May 28, 2025

- CBN Launches New Financial Tools to Boost Nigeria’s Non-Interest Banking Sector! ✨

- Market Watch: Key Updates as Wall Street Awaits Nvidia and Salesforce Earnings

- U.S. Equity Markets Rally as EU Tariff Deadline Is Extended and Consumer Confidence Surges

- Things to Know Before the U.S. Stock Market Opens

- What to Expect in the Markets This Week (May 27–31)

Start investing with Acorns today! Get $5 when you use my invite link: Z24WWE