By admin Dec, 08, 2020 Featured

How Does ADP Payroll Work? As a business owner or an HR professional, you may be looking for an automated solution to your employees' salary requirements. ADP Payroll is one of the most popular options in the payroll software market. It offers several additional packages and features to choose from. Knowing how ADP services work can help you decide which services are best for your business.

What Is ADP?

ADP is what you can call a workforce management service. This means that ADP offers a wide variety of options to help you manage your company's HR functions.

The best known is of course the payroll. However, even their most basic payroll service is more than simply cutting checks. For example, one of the features included in each of ADP's three payroll packages in health care compliance, which is designed to help you understand your responsibilities under the Affordable Care Act and any changes in healthcare reform.

The company also offers great customer support, with one person answering your questions 24/7 online or over the phone. They also offer a variety of online resources, including a newsletter and weekly tips.

What Are the Benefits of ADP?

- ADP's most basic program allows you to complete your payroll online and promises secure data transfer and storage.

- You can choose live checks or direct deposit (or both), and you and your employees can log into ADP to check and manage personal information.

- Payroll tax withholding is calculated automatically and deducted from employee pay. In addition, ADP files and deposits your organization's payroll taxes, and even guarantees their accuracy so long as the data you provide is accurate.

- You can also use the software to manage employee benefits (depending on the package you choose), and create posters to hang in the workplace to ensure compliance with state and federal statutes.

- It also ensures you remain compliant by filing relevant paperwork on new hires. At the end of the year, ADP creates and issues W-2s and 1099s to your employees and contractors.

ADP's Basic Idea

The main idea behind the ADP experience is simplicity and automation. Once the initial data has been entered into the system, the payroll can be processed easily with just a few clicks.

Instead of manually entering an employee's hours worked, wage rates, tax rates, and deductions into a spreadsheet, the ADP software executes each step quickly and automatically. HR managers can review the payroll before processing and then approve the payroll for payment.

As a cloud-based program, no physical software needs to be purchased and installed on your system. Simply log into your ADP account online and set up your salary information. The service can be accessed from your computer or through the ADP mobile application on a smartphone or mobile device.

What Features Does ADP Payroll Include?

ADP offers three payroll plans: Essential Payroll, Enhanced Payroll, and Complete Payroll + HR. All three plans include the following:

Payroll

- Run payroll via any connected device, even mobile

- Direct deposit

- Payroll delivery, with a guarantee that you receive your checks in time to distribute them

- A variety of reports you can access and export

- General ledger interface you can export to QuickBooks, Xero, or Creative Solutions

- New hire reporting to meet state and federal requirements

- 1099 creation; W-2 creation and filing

- Calculate, file, deposit, and reconcile payroll taxes, with a guarantee to pay any fees in the event of an ADP error

HR

- State and federal resources to help you meet documentation requirements

- Health care compliance

- HR check-ups to compare your standards against best practices

- HR dictionary

- Weekly tips

- HR newsletter

If you upgrade to either advanced package, you get ADP's full list of payroll features, including Secure Check signing and stuffing, prepaid cards to deposit employee pay on a Visa debit card instead of a live check or direct deposit, State Unemployment Insurance, and garnishment payment service.

The Complete Payroll + HR package also includes substantial HR support, including background checks, job posting, applicant tracking, job descriptions, employee handbook creation, training, and auditing assistance. ADP also offers a la carte options, including employee information tracking, alerts and notifications, and a document vault.

How to do payroll on ADP

At this point you might be asking, how do I do a payroll on ADP?

To start the payroll process, you'll need to set up your business account with some basic information, including the following:

- Information specific to your business, including payroll schedule, benefits offered, and banking information.

- Name, address, social security number, wage rate, and a specific withholding tax rate of the employee.

- Employee banking information if you offer direct deposit.

To do the payroll, first look at all the hours of your employees. If you use the time tracking component, employees can log in from their smartphone and the data is automatically added to the company's accounting files.

You can then make any adjustments necessary to account for overtime, add earned bonuses, or add payments from contractors.

Direct deposit payments are processed electronically. Checks will be delivered to your office for delivery the next payday. Payments can also be made with debit cards.

The ADP payroll service also includes quarterly and annual tax returns, as well as tax returns on your behalf. If you have any questions, the company's professional staff are available 24/7 to provide answers.

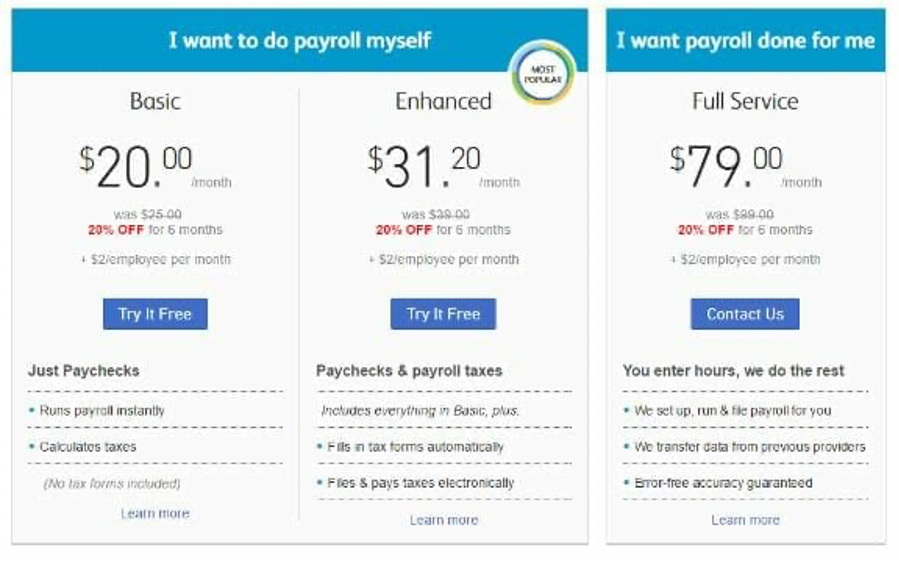

How Much Does ADP Payroll Cost?

Since a company's needs depend on both its size and the structure of its HR department, ADP services differ from company to company. Every company has to buy what it really needs or wants. Prices are not listed on the company's website as prices are customized for each customer based on the size of the payroll that the company wants to manage and the additional features it offers it chooses to use.

The basic packages are as follows:

ADP for small businesses that have from one to 49 employees

Run Powered by ADP is a service designed for small businesses. It is available in four separate packages - from Essential to HR Pro. Features include basic payroll, including direct deposits, tax forms, and tax reports. The more robust packages contain additional functions that extend the HR function. Payroll features include garnishment and UI compliance, while HR managers can get help with:

- Creating an employee handbook.

- Having a job description wizard.

- On-boarding new employees.

- Training personnel.

ADP for mid-sized businesses that have from 50 to 999 employees

This is designed for midsize businesses and enables HR departments to focus more on human capital management issues rather than just searching through day-to-day activities of payroll, tax compliance, and accounting. Administration of services. The features of this program are as follows:

- Simple tax reporting and compliance, for reducing errors.

- Logging time and attendance, as well as managing overtime and vacation.

- Identifying trends and predicting hiring needs.

- Communication tools for managers.

- Tracking internal talent performance and improving retention.

- Managing retirement and insurance plans.

- Options for outsourcing components.

ADP for large enterprises for businesses that have at least 1,000 employees

The ADP flexibility enables a company to continue with its growing service. The larger a company becomes - especially if it extends to several states or into several countries - the higher the risk of compliance issues arising from changing regulations. The ADP service help companies keep abreast of all laws and change the tax rate, adjusting payroll calculations if necessary. Large Business ADP Services can also:

- Analyze the use of employee hours and help companies become more productive.

- Provide employees with additional benefit-management options.

- Serve specific industries–such as hospitality, manufacturing, financial or retail services –with customized software that incorporates industry-specific needs into the payroll, such as the following:

Employee Access to Information

With the ADP Payroll services, employees can also access all company data via the mobile app. This offers an environmentally friendly solution for companies as well as cost savings by reducing the amount of paper used. Employees can access pay stubs from their smart devices.

Add family members to their health insurance; change their allowances; everyday time; Request time out and sign up for direct deposit by adding bank details. Department managers can also easily view basic information about employees in their workgroup and then send them a message through the app.

How long must a company keep payroll records?

Employers must record and preserve specified information and records to show compliance with Fair Labor Standards Act (FLSA) provisions relating to minimum wage, overtime, equal pay and child labor.

Review the federal record-keeping requirements for all non-agricultural employees.

For each employee COVERED by FLSA:

Retention Period: 3 Years Required Information & Records:

- Name, address

- Date of birth

- Gender, occupation

- Workweek days

- If paid O/T... regular pay rate and exclusions

- Wage basis

- Hours worked

- Straight-time earnings

- Weekly overtime pay

- Deductions from and additions to wages

- Pay period covered

- Pay dates

- Wages paid by pay period

- Retroactive payment

- Also, payroll certificates, union agreements, and benefit plan documents.

Supplemental records:

Retention Period: 2 Years Required Information & Records:

- Timecards

- Wage rate tables

- Work time schedules

- Job evaluations, etc.

For each "white collar" employee EXEMPT from FLSA:

Retention Period: 3 Years Required Information & Records:

Executive, administrative, professional, and outside sales employees are exempt from the overtime and minimum wage requirements of FLSA. Records are kept to substantiate the claimed exemption, including:

- The wage basis for the exempt employee (e.g. $500 per week)

- Total remuneration (sum of pay plus fringe benefits

For each employee paid SUB-MINIMUM wage rate:

Retention Period: 3 Years Required Information & Records:

- Qualifying learners, apprentices, and handicapped employees, for example, may be employed at sub-minimum wage rates. However, the employer must first obtain the proper authorization certificate from the Secretary of Labor. The certificate must be preserved in the employer's records for a specific period from the certificate's expiration date.

- Also, the employer must identify any employees paid at a sub-minimum wage rate, using a letter symbol on their pay records, and the employer must retain evidence substantiating the special characteristics of the employee that justify the sub-minimum wage rate.

- The foregoing requirements are in addition to the normal record-retention requirements applicable to employees covered by the FLSA.

Record keeping to substantiate special wage/hour practices:

Retention Period: 3 Years Required Information & Records:

- For example, employers who credit tips toward the minimum wage requirement must record the following items, in addition to the information normally applicable to a covered employee: weekly or monthly tip amount reported by the employee, amount of tip credit taken, hours of untipped work and hours of tipped work.

- Another example is an employer that pays employees on a piece-rate basis. In addition to the information normally required for a covered employee, the employer must record each piece rate applicable to the employee. The employer must record the number of units completed at each applicable rate during the hours worked in excess of the statutory workweek, and the total weekly overtime excess compensation for the employee at the applicable rate.

In Summary:

Plan costs vary according to which service you choose and the number of employees you have. The basic package starts at $10 per employee, per month, with fees typically paid each time you pay your employees (bi-monthly, every two weeks, etc.). More advanced plans cost around $23 per employee, per month.

On average, you can expect to pay around $160 per month for 10 to 15 employees. You may also have start-up fees (typically around $25, though these are often waived) and yearly fees for processing taxes. Exact prices vary greatly, however, since ADP regularly offers deals and discounts, so talk to a representative to get an accurate quote.

If you are considering using the ADP payroll service, but you want to see the program in action before you purchase it, the company offers basic demos of the various packages on its website.

You can also get a free quote, based on the package, and a selection of services that you may want to use. The company also offers a bonus of two free months of service for new clients.

Tags: ADP Payroll HR Salary investments

Share On Facebook Twitter Linkedin Whatsapp Telegram

Categories

Latest Post

- Nigeria Taps Global Markets with $2.25B Eurobond Sale

- Boeing Shares Rise as CEO Confirms China Deliveries to Resume Next Month

- STOCK SPOTLIGHT: UNION HOMES REAL ESTATE INVESTMENT TRUST (UHREIT)

- Nvidia Q1 2025 Earnings Report Summary

- 📉 U.S. Market Summary – May 28, 2025

- CBN Launches New Financial Tools to Boost Nigeria’s Non-Interest Banking Sector! ✨

- Market Watch: Key Updates as Wall Street Awaits Nvidia and Salesforce Earnings

- U.S. Equity Markets Rally as EU Tariff Deadline Is Extended and Consumer Confidence Surges

- Things to Know Before the U.S. Stock Market Opens

- What to Expect in the Markets This Week (May 27–31)

Start investing with Acorns today! Get $5 when you use my invite link: Z24WWE