Crop Futures Slumping Due To Coronavirus Outbreak In China

- Posted on January 28, 2020

- Editors Pick

- By admin

Recently, crop futures traded in

Chicago sank as China’s death toll from the coronavirus outbreak increased amid

government reports that the infection was spreading more quickly, threatening

demand in the world’s largest consumer of agricultural commodities and the

biggest soybean importer.

A lot of food crops prices have

dropped. For instance, soybeans dropped below $9 a bushel for the first time

since early December and have lost more than 6% this month, while corn was down

by over 1% and wheat fell by 2% as selling gripped global financial markets in

a deepening risk-off mood.

A report by Bloomberg says the lockdown

on movement and travel in many areas of China and the preference among the

country’s people to stay at home while the outbreak rages rather than eat at

restaurants look set to hammer demand in a nation already ravaged by African

swine fever, which has slashed hog herds, and reduced consumption of livestock

feed, such as soybean and rapeseed meal.

China is the world’s top producer

and consumer of rice and wheat, and the second biggest for corn. The outbreak

of the virus is adding a blow to agricultural markets hoping for more Chinese

purchases of American farm products after the signing of the U.S. trade deal

earlier this month.

On Sunday (Jan 26),

Chinese authorities said the virus isn’t yet under control despite aggressive

steps to limit the movement of millions of people who live in cities near the

center of the outbreak.

The country has however extended

the Lunar New Year break to Feb. 2, having originally been slated for Jan. 30.

Analysts view of the effect of the outbreak on the stock market

National Securities

chief market strategist, Art Hogan said in an interview: "My guess is if we're

going to rationalize a market that's pretty stretched right here, it's going to

happen right now. We have about a third of the S&P 500 reporting. We're going

to see the losers lose a whole lot more than we've seen in a while. The index

itself could probably pull back 3% to 5%. Stocks are relatively priced for

perfection, and you tend to have bad news or in-line news when that happens".

Hogan has insinuated

that the week could be likely rough as futures on the DJIA (-1.49%), S&P

500 (-1.15%) and the Nasdaq Composite (-1.96%) have all showed a lower opening

prices.

Effect of the outbreak on the Dow Jones Industrial Average

With the rapid spread of the Coronavirus, the

Dow Jones futures have plunged. Apple and Telsa seem to be the leader with

huge earnings. The market tumbled today (Jan. 27). The stock market rally

retreated last week due to the coronavirus outbreak. While Apple (AAPL) stocks

edged lower last week, shares of AMD, Microsoft and Facebook fell; and Telsa stock surged 11%.

The fiscal Q1 earnings

for Apple are expected on Tuesday night and analysts expect the shares to climb

8% to $4.53 per share, while revenue rises 5% to $88.35 billion. Wall Street

predicts a growth of 10% in Apple's earnings in fiscal 2020 and 16% in 2021. On

the DJIA, Apple stocks reversed from a high on Friday, and the shares further

went down by 2% in the premarket.

Wall Street believes

that shares of AMD will surge 289% to 31 cents with sales jumping by 48% to

$2.11 billion. Stocks of AMD on Friday fell by 2.6%. AMD was a part of the

early 2019 stock rally, however, its shares sank today by 3.5%.

Telsa's earnings are due

late Wednesday and analysts expect the earnings to fall 15% to $1.65 per share

with its revenue down by 4% to $6.45 billion. Telsa expects to deliver this

year in the areas of production and demand. On Friday, shares of Telsa were on

the edge and leaped 10.6%. Telsa being among the top earners of last week shows

that investors are confident despite concerns of the rapid coronavirus

outbreak.

Analysts predict

Facebook's earnings to rise by 6% to $2.52 per share, with a revenue up by 23%

to $20.87 billion. The tech giant's earnings are expected to jump 44% in 2020.

Microsoft's stock

retreated 1.2% last week and the shares fell by about 2% in the early hours of

today's trading.

The Dow Jones futures

fell 1.55% versus fair value. The S&P 500 futures dropped by 1.5%, while

the Nasdaq 100 fell by 1.9%. Stock markets have been closed for holidays in

China, Hong Kong, South Korea, and Australia. Dow Jones futures could become

volatile with the coronavirus crisis expanding in the peak earnings week.

It is important to note

that airlines hotel, commodity and other Chinese companies were the notable

losers of the week. Chinese e-commerce giant, Alibaba (BABA) sank by 6% but it

still remains above the 50-day line.

The Dow Jones is 2.2%

above the 50-day line. The S&P 500 index is 3.1% above the 50-day line, the

Nasdaq composite is at 5%, while the Nasdaq 100 is at 5.9%.

According to analyst

reviews, major indexes have been up since the first week of December 2019. The

coronavirus could trigger a pullback in the stock market, even though the

market rally has been due for a pullback.

The China Coronavirus Outbreak

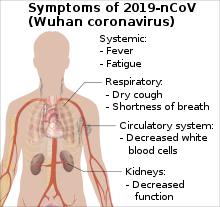

As of Monday morning,

the cases of the outbreak were put at 2,744, while 80 deaths were confirmed.

Health officials said the virus can be spread from individuals even before they

become symptomatic, making it difficult to contain the virus. About 15 cities

and 57 million residents are currently under travel restrictions, however, millions left earlier for the Lunar New Year.

The United States

currently has five confirmed cases of coronavirus. Other countries like France,

South Korea, Australia, Thailand, and more have also confirmed cases of the

virus.

As major stock indexes

continue to plunge as a result of the pressure of the coronavirus outbreak, some

indexes have already noted solid gains through the close of trading on Friday.

Investingport hopes to keep an eye on the stock market to bring in timely

reports.

Be the first to comment!

You must login to comment