Could there be a recession in the coming days?

Following the close of Thursday's North

American session, US forecasts, as measured by the 10-year breakeven inflation

rate, had fallen for the second day in a row, according to data from the St.

Louis Federal Reserve (FRED). However, the inflation rate has just reduced to

2.58 percent.

Given the recent drop in inflation predictions, the

new Fedspeak highlights concerns about excessive inflationary pressures in the

world's largest economy. Minneapolis Federal Reserve President Neel Kashkari,

US Treasury Secretary Janet Yellen, and Cleveland Federal Reserve Bank

President Loretta Mester were among those in attendance.

Treasury Secretary Janet Yellen said Sunday, in an

interview that the recession that many Americans anticipate is looming is

not "at all imminent."

“I expect the economy to slow,” Yellen said in an

interview. “It’s been growing at a very rapid rate, as the economy, as the

labor market, has recovered and we have reached full employment. It’s natural

now that we expect a transition to steady and stable growth, but I don’t think

a recession is at all inevitable.”

Despite Yellen's optimism about averting recession,

the world economy is vulnerable in the next months due to the ongoing conflict

in Ukraine, rising inflation, and the Covid-19 outbreak. Yellen stated,

"Clearly, inflation is unacceptably high."

Notwithstanding this, she does not anticipate that a

decline in consumer spending could lead to a recession. Yellen said that

the labor market in the United States is the best it has been since World War

II, and that inflation will moderate "in the months ahead."

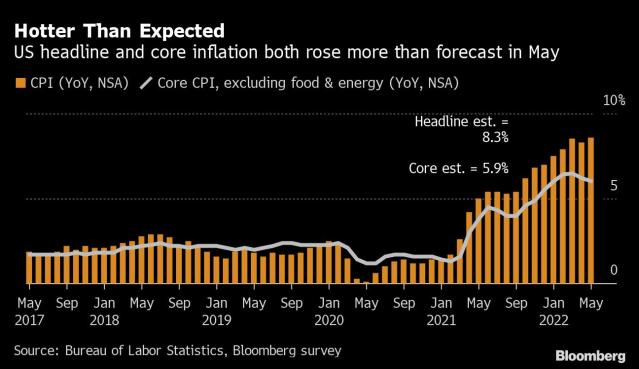

As inflation continues rising and the Federal Reserve

takes strong efforts to combat it, speculation of a recession has increased

this year. The Federal Reserve raised interest rates by 75 basis points on

Wednesday, the highest increase since 1994. Fed Chair Jerome Powell also stated

that the Federal Open Market Committee intends to keep strengthening monetary

policy in to keep inflation under control.

Simultaneously, many people remain convinced that a

combination of consumer spending resiliency and job growth will pull the

US out of a possible recession.

According to celebrity investor Kevin O'Leary, the US

economy is considerably bigger than most people believe, and there is "no

evidence" of an oncoming downturn or recession. He stated that he has

investments in a broad array of industries, including commercial kitchens,

wireless charging, gym equipment, and greeting cards. He also says he hasn't

seen "any indication" of a downturn.

″I’m not saying we won’t get one, but everybody that’s

saying it’s coming around the corner next week is just wrong,” O’Leary told

CNBC’s “Squawk Box Asia” on Thursday. “I see their tear sheets each week. We

don’t see slowdown yet,” he said, referring to a document summarizing key

information about a company. “I think I’ll be one of the first to see it. I’m

sort of a canary in the coal mine in that respect.”

As a result, the market's skepticism of inflation

predictions appears to be weighing on appetite for risk, keeping mood heavy

ahead of Fed Chair Jerome Powell's important testimony.

It's important to note that Fed Chairman Powell would

have a difficult time defending the current 0.75 percent rate rise without at

least mentioning the economic difficulties.

The US market will be restricted on Monday due to the

Juneteenth holiday, but growth uncertainties and discussion of aggressive Fed

predictions might keep the risk-off sentiment alive.

Check Hubforjobs for recession-proof jobs.

Be the first to comment!

You must login to comment