Charles Schwab Made A Bid To Buy TD Ameritrade For $26 Billion All-Stock Deal

- Posted on November 26, 2019

- Editors Pick

- By admin admin

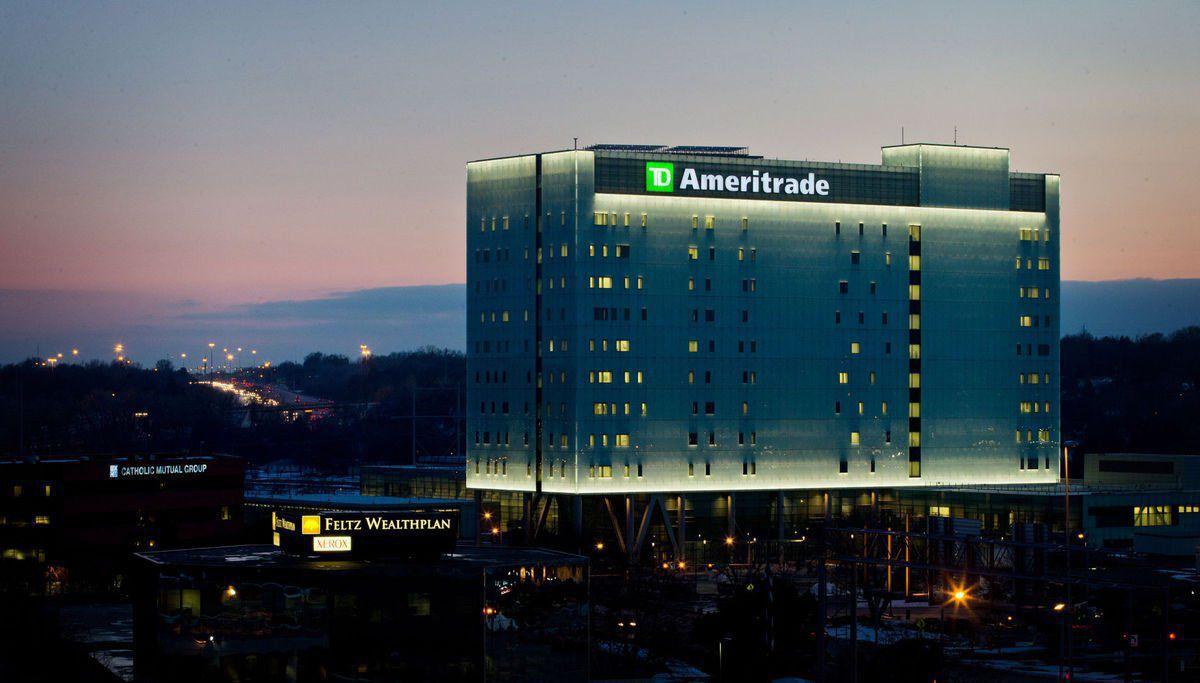

Charles Schwab Corporation has agreed to buy TD Ameritrade Holding Corporation at $26 billion, a multibillion-dollar deal that will reshape the

retail brokerage business. The equity value of the deal is

$28.3 billion based on Schwab’s closing price of $48.20 on 22nd November.

Announcement of the deal comes after

news of an acquisition broke on Thursday, sending up the shares of both firms.

Schwab, America’s original discount broker, will now have even more sway over

the sector pioneered nearly a half-century ago.

According

to a statement on Monday, the combined firm will relocate its headquarters to

to Schwab’s new campus in Westlake, Texas, however, Schwab’s San Francisco operations will

remain a sizable hub.

According

to Bloomberg, TD Bank, which holds 43% of TD Ameritrade, will own roughly 13%

of the new business. Its voting stake will be limited to 9.9%, with the rest of

its position in a non-voting class of stock. The Canadian lender will have two

new seats on the combined firm’s board, while TD Ameritrade will name a single

director.

Walt

Bettinger, Schwab’s chief executive officer, said in the statement that the new

firm will have “the resources of a large financial services institution that

will be uniquely positioned to serve the investment, trading and wealth

management needs of investors across every phase of their financial journeys.”

Recommended:

Schwab/Ameritrade: end run, end game

Credit:

Bloomberg

Be the first to comment!

You must login to comment