CastleOak Securities is among the largest African-American owned investment banks

- Posted on July 08, 2020

- Stock Market

- By Glory

CastleOak Securities. L.P, founded in 2006, is a boutique investment bank and one of the largest African-American owned investment banks that concentrate on the capital markets. CastleOak specializes in both primary and secondary sales, as well as the trading of equity, fixed income, and money market securities. The firm serves a wide array of corporate, institutional, and governmental investor clients. It has its headquarters in New York City, with five regional offices.

Since its establishment in 2006, the CastleOak has significantly expanded in capacity, featuring nearly 50 professionals. It has also assisted different clients on public offerings totaling more than $2 trillion. The investment bank has ranked among the nation’s topmost active underwriters of agency and equity securities, as well as investment-grade corporate debt, consistently, according to Thompson Financial.

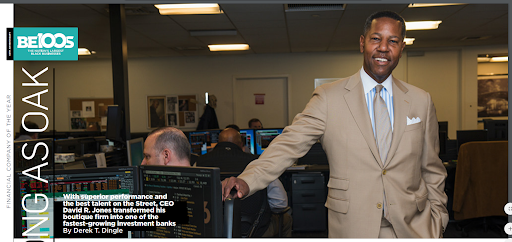

In 2017, Black Enterprise Magazine named CastleOak its Financial Company of the Year. The magazine described the investment bank as “a magnet for leading corporate, government, and institutional clients as well as the Street’s most talented traders and investment bankers.”

CastleOaks’ management team includes co-founder, president, and chief executive officer David R. Jones, co-founder, managing director, and general counsel Nathaniel H. Christian, co-founder chief financial officer and director of operations Philip J. Ippolito, senior managing director, and head of fixed income marketing Patrick de Catalogne, executive vice president and head of investment banking, Michael A. Turner.

CastleOak and other firms like it bring diversity into the investment banking world. Not diversity as regards race alone, but diversity as regards providing more options in diversified investing. According to Jones, when selling securities “you don’t want to be beholden to one or two or three buyers. Corporations look to us to bring in smaller money managers that might typically get shut out in a bond deal or an equity deal.”

CastleOak secured its first major deal through helping General Electric to raise $300 million through the sale of “floating-rate bonds.” Preceding that time, Jones had already established a good business relationship with the management of General Electric.

“Our goal is not to replace the larger banks,” Jones said. “It’s just to take some of their economics.” There are no prevalent threats to CastleOak or larger banks when it comes to investment banking because companies can include as many banks in their capital transaction. Such that, CastleOak doesn’t necessarily need to compete head-on with large investment banks, but can participate in deals with them. For example, in 2018 when GM Financial issued $1.25 billion in bonds, CastleOak was one of the 10 investment banks that comanaged the sale.

“If you know how the economy works, it’s really smaller businesses that drive it.”

Be the first to comment!

You must login to comment