Cash App Investing: Square Inc adds No Fee stock trading option to Cash App

- Posted on December 10, 2019

- Editors Pick

- By admin

Cash App is a peer to peer cash payment app that's owned by Square Incorporated. The company has taken a step to simplify trading of stocks (buying and selling of stocks) and at the same time, offering these services to its users at no cost. The company announced this in a series of tweets on Thursday, October 24th, 2019.

Square Inc. (NYSE: SQ) is a financial service, merchant services, and mobile payment company that is based in San Francisco, California. The company

is involved in the marketing of various software and hardware payment; and

within a short period of time, it has expanded into other business services.

The company was founded by Jack Dorsey and Jim Mckelvey in 2009 and had its

first app and service launched in 2010. The company has been trading as a

public company since November 2015 on the New York Stock Exchange.

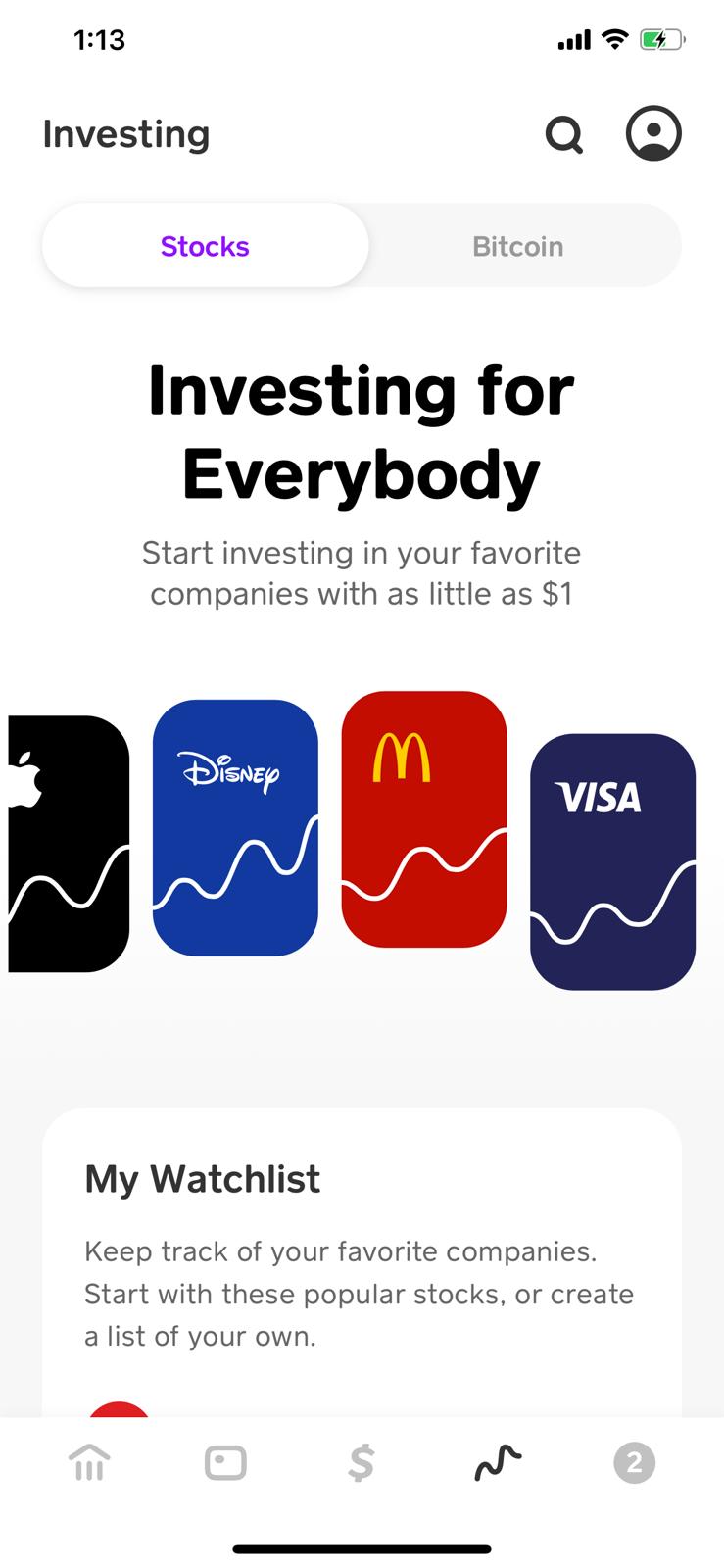

Cash App Fractional Shares breakdown

The Cash App investing will provide fractional services where

investors can buy small amounts of shares of a particular company rather than a

whole more expensive share. Jack Dorsey's Cash App would allow investors to

purchase fractions of any stock for as low as $1.00. Investing Port believes

this is a very great move as new potential investors would be able to trade

freely using the app without any form of barrier due to high transaction fees.

Cash App Stock Trading Fee

Square's Cash App will not be the first to start offering less or no transaction fees to stock investors. The company decided on its no-fee stock transcation after Charles Schwab Corp. (NYSE: SCHW) announced at the beginning of October that it was going to offer zero transaction fees, which was followed suit by TD Ameritrade Holding Corp and E-Trade Financial Corp.

To be clear, Cash App does not charge any stock trading fee at this time. However, the company stated on its website that third-party affiliates may assess fees on any trades made on Cash App's platform.

More on how Cash App Stock trading works

According to square (NYSE: SQ), the feature is meant to lower

the barrier for investing, hence enabling young investors to be able to

participate in the stock market. Complex trade options, for instance margin

trading will not be available, however basic buying and selling of stocks and

ETFs will be offered.

According to square Inc., the feature will be rolled out to

customers very soon and its brokerage services will be done via the Cash App

Investing LLC.

In a tweet, Square Chief Executive Officer expressed his

delight saying, "Really proud of the team for making buying stocks and

building wealth accessible to more people."

Cryptocurrency buying on Cash-App

Square Inc. was able to create publicity for its app when it

started enhancing the purchase of the cryptocurrency, bitcoin through its

service about 2 years ago. Investors were astonished when the company further

gave a sneak peek into the financials behind that feature which displayed only

a small margin in relation to bitcoin activities.

According to a report by market watch, the main goal of Square

does not seem to maximize revenue, rather the company is thought to be packing

features into App so that consumers will start storing money there. By this

means, consumers will make purchases using an associated debit card to make

purchases, allowing Square to collect transaction fees on the back end when

users make a purchase online or swipe their cards in store.

How to use Cash App to send money

1. Download Cash App via your phone

2. Sign up for an account and add your bank card to send or to receive money from others.

3. Confirm your Debit card or bank account

4. Start sending or receiving money from people via your contact

How to Invest via Cash App

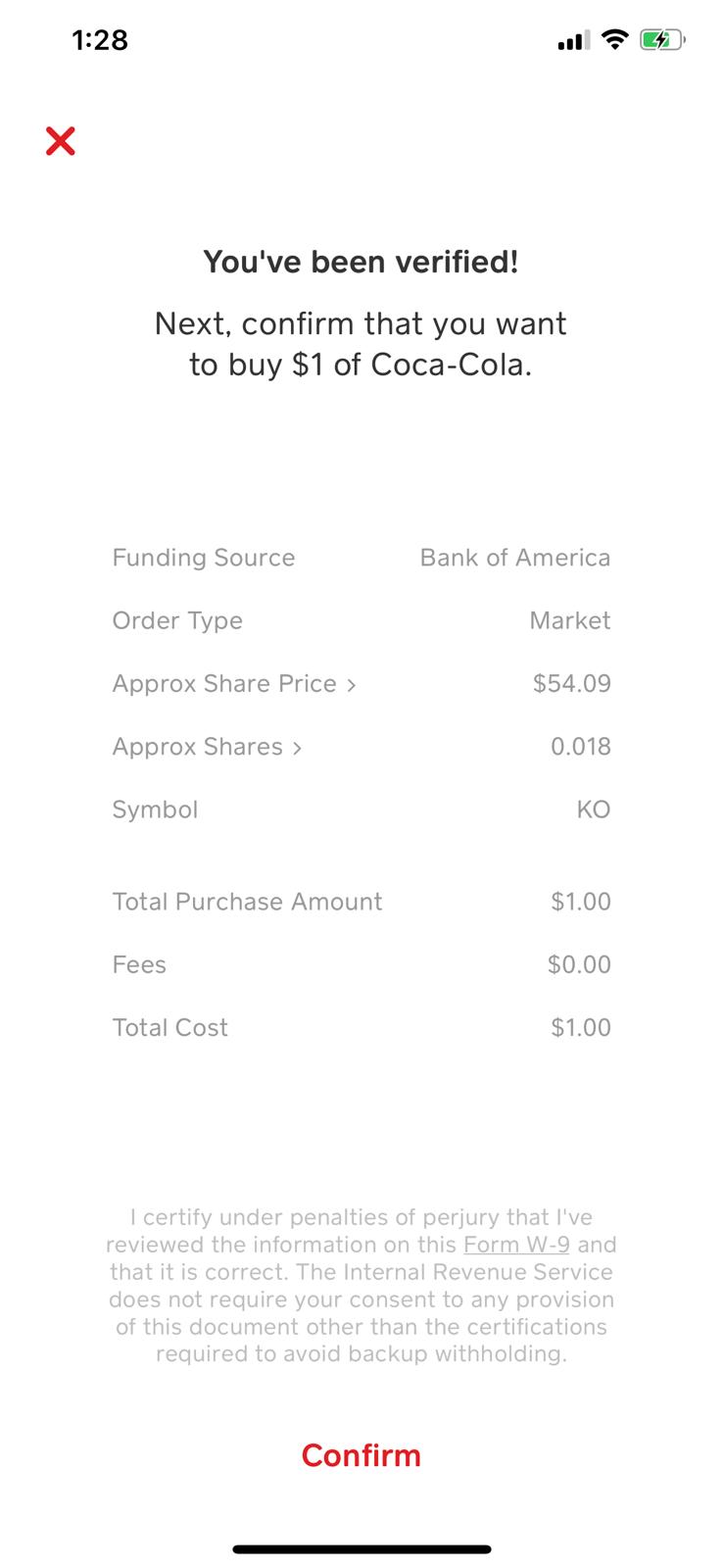

Investing in stocks can be done easily via CashApp. It's just as simple as sending money to people but if you are investing for the first time, you will need to give Cashapp additional information about yourself. After giving them your information, proceed to the steps below.

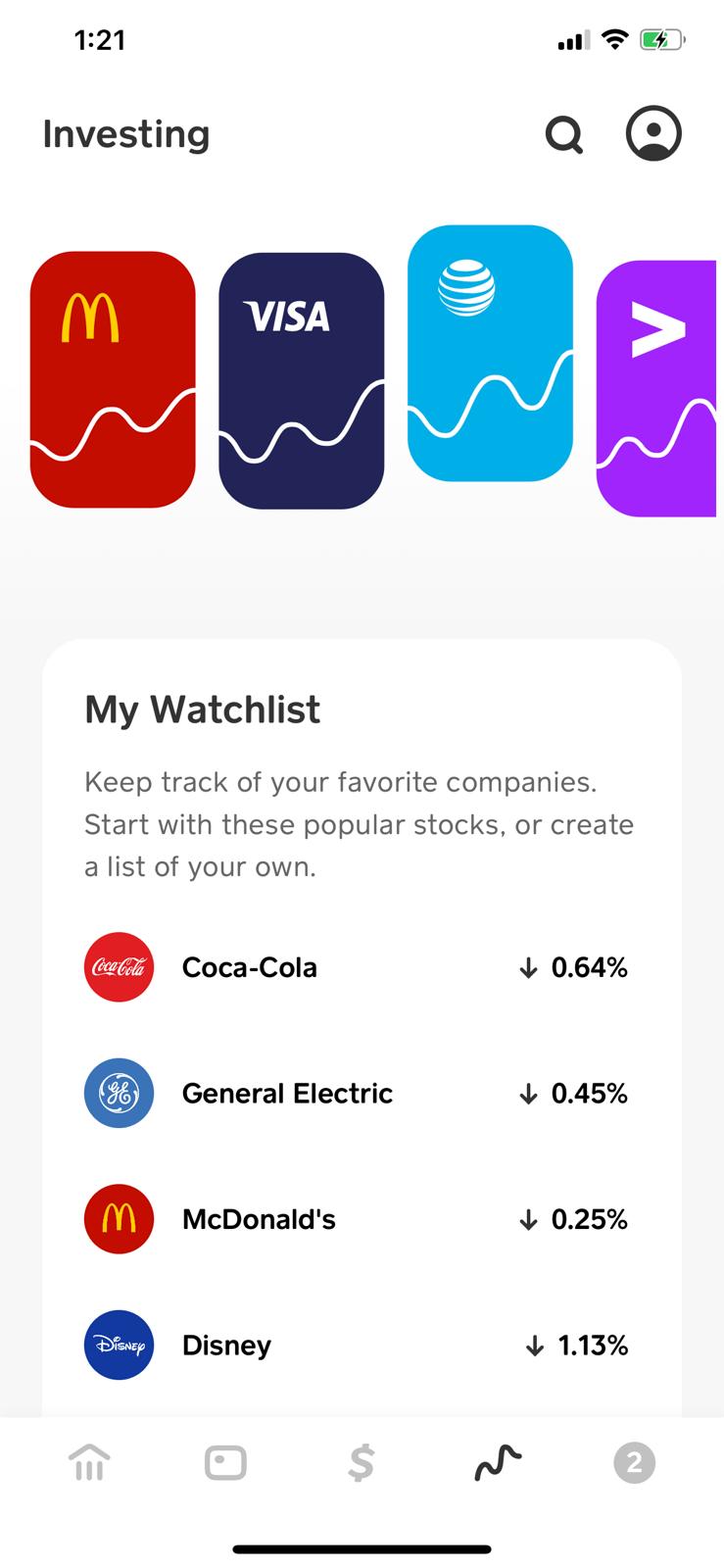

1. Logon to the Cashapp, scroll to the bottom of the app and tap the investment sign, it the

3rd sign to the left (If you are using your phone), it looks like a spiral upward graph.

2. Tap the upward spiral graph sign and it takes you to the investment page.

3. Confirm your email address on this page if you have not done so. Cash App will send an email notification and you will have to go into your email to retrieve the code.

4 Copy the 6 digit code that was sent to you, and enter it on Cashapp.

5. It will ask you about your employment status. This step basically collects more information about you.

6. Then it will ask you some questions like, are you affiliated with FINRA, etc, these are the normal questions that all investment platforms must ask.

7. Select a 4 digit cash PIN for additional security.

8. The app should have confirmed the verification process at this point.

After you have been verified, you may begin buying and selling stocks on CashApp.

Things to keep in mind about Investing via Cash App

Taxes are important, make sure that you file all proceeds when you file your tax at the end of the year. If you do not file your taxes accordingly, you may get audited and that comes with a penalty.

Does Cash App charge a fee to buy stocks via Cash app? : Again, Many firms charge a fee when you buy and sell stocks. They also charge a fraction percentage in addition to the buying and selling fee where applicable. However, Cash App does not charge any fees to buy or sell stocks on its platform.

What is the minimum amount that one can invest via Cashapp? This may come as a surprise but you can invest as little as $1 dollars in stock. Yes, a lot of value stocks are higher than $1 in prices, and buying a stock for a dollar makes it possible to buy a tiny fraction of a company.

Be the first to comment!

You must login to comment